Cisco 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

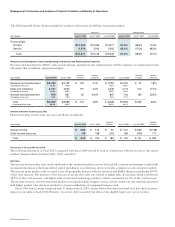

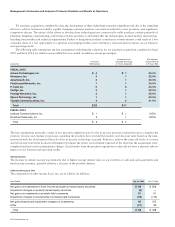

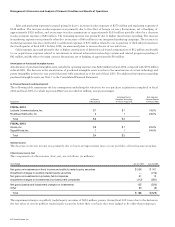

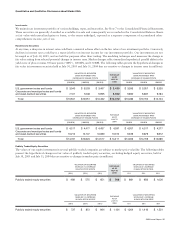

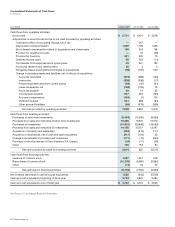

Inventories The following table summarizes our inventories (in millions):

July 30, 2005

$ 82

431

385

184

569

180

35

$ 1,297

Annualized inventory turns were 6.6 in the fourth quarter of fiscal 2005, compared with 6.4 in the fourth quarter of fiscal 2004.

Our finished goods consist of distributor inventory and deferred costs of sales and manufacturing finished goods. Distributor inventory

and deferred cost of sales are related to unrecognized revenue on shipments to distributors and retail partners and shipments to

enterprise and service provider customers. Manufacturing finished goods consist primarily of build-to-order and build-to-stock

products, including home networking products. Service-related spares consist of reusable equipment related to our technical support

and warranty activities. All inventories are accounted for at the lower of cost or market.

Inventory management remains an area of focus as we balance the need to maintain strategic inventory levels to ensure

competitive lead times against the risk of inventory obsolescence because of rapidly changing technology and customer requirements.

We believe the amount of our inventory is appropriate for our current revenue levels.

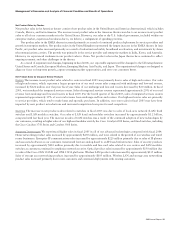

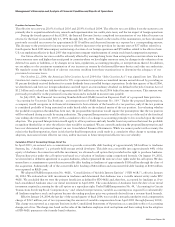

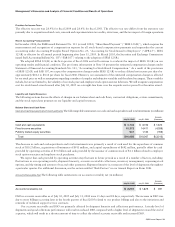

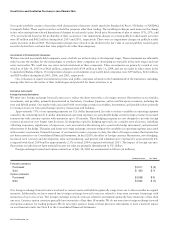

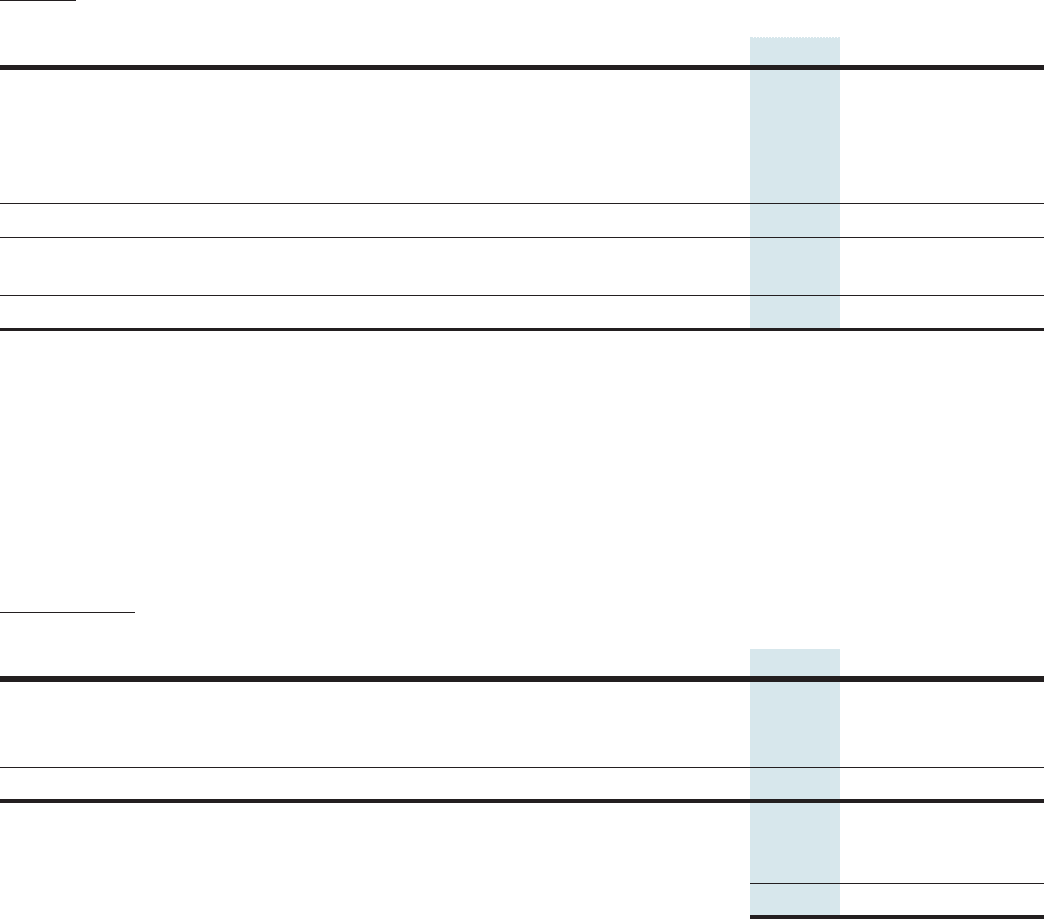

Deferred Revenue The breakdown of deferred revenue was as follows (in millions):

July 30, 2005

$ 3,618

1,424

$ 5,042

$ 3,854

1,188

$ 5,042

The increase in deferred service revenue reflects the impact of the increase in the volume of technical support contract initiations and

renewals, partially offset by the ongoing amortization of deferred service revenue. Deferred service revenue is recognized ratably over

the service period, which is typically one to three years.

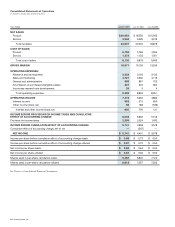

Management’s Discussion and Analysis of Financial Condition and Results of Operations