Chrysler 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Report on Operations Corporate Governance54

executive directors, and as envisaged in Article 12, the Vice

Chairman, if appointed, shall act as Chairman if the latter is

absent or prevented from acting. As in the past, the Board of

Directors adopted a model for delegation of broad operating

powers to the Chairman and the Chief Executive Officer,

authorising them to severally perform all ordinary and

extraordinary acts that are consistent with the Company’s

purpose and not reserved by law or otherwise delegated or

reserved to the Board of Directors itself. In practice, the

Chairman exercises coordination and strategic guidance within

the activities of the Board of Directors, while the Chief

Executive Officer is in charge of the operating management of

the Group.

The Board defined the “Guidelines for Significant Transactions

and Transactions with Related Parties,” by which it reserved the

right to examine and approve in advance any transaction of

significance in the balance sheet, economic and financial

figures, including the most significant transactions with related

parties, and subject all transactions with related parties to

special criteria of substantial and procedural fairness.

Therefore, decisions regarding significant transactions are

excluded from the mandate granted to executive directors. The

term “significant transactions” refers to those transactions that

in and of themselves require the company to file a prospectus

regarding such transaction, in accordance with the specific

rules established by market supervisory authorities. When the

Company needs to execute significant transactions, the

executive directors shall provide the Board of Directors

reasonably in advance with a summary analysis of the

strategic consistency, economic feasibility, and expected return

for the Company. Decisions regarding the most significant

transactions with related parties are also excluded from the

mandate granted to executive directors, with all such

transactions being subject to special rules of substantial and

procedural fairness and disclosure to the Board.

Pursuant to Article 12 of the By-laws, after receiving the

opinion of the Board of Statutory Auditors, the Board of

Directors shall appoint the manager responsible for preparing

the Company’s financial reports. The Board of Directors may

vest with the relevant functions more than one individual

provided that these individuals perform such functions

together and have joint responsibility. Only a person who has

acquired several years of experience in the accounting and

financial affairs at large companies may be appointed.

In execution of this provision of the By-laws, at its meeting of

April 23, 2007, the Board of Directors appointed the heads of

the Group Control and Group Treasury functions as jointly

responsible for preparing the Company’s financial reporting,

vesting them with the relevant powers.

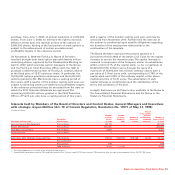

At December 31, 2007, the Board is comprised by three

executive directors and twelve non-executive directors – that

is, who do not hold delegated authority or perform executive

functions in the Company or the Group –, eight of whom

qualified as independent.

The executive directors are the Chairman, the Vice Chairman,

who substitutes for the Chairman if the latter is absent or

prevented from acting, and the Chief Executive Officer. They

also hold management positions in subsidiaries: Luca Cordero

di Montezemolo is Chairman of Ferrari S.p.A., John Elkann is

Chairman of Itedi S.p.A., and Sergio Marchionne, in addition to

being Chairman of the principal subsidiaries, including CNH

Global N.V. – a company listed on the NYSE –, is also Chief

Executive Officer of Fiat Group Automobiles S.p.A.

An adequate number of independent directors is essential to

protect the interests of stockholders, particularly minority

stockholders, and third parties. In order to achieve this objective

and in the conviction that enhancing protections against potential

conflicts of interest is a priority for the Company, particularly in

those areas less prone to control by the Stockholders Meeting, the

Board of Directors submitted a motion to the Stockholders

Meeting, on the occasion of the appointments of May 3, 2006,to

confirm the principle of a board with a majority of independent

directors as well as the selective criteria for determining

independence, already adopted in 2005. This principle was

accepted by the Stockholders Meeting and reaffirmed on the

occasion of the co-optation of René Carron, in replacement of

resigning Director Hermann-Josef Lamberti, which took place on

July 24, 2007. During 2007, the Board of Directors was made up of

a majority of independent directors.

The qualifications of independent directors are assessed

annually and based on the absence or non relevance during

the previous three years of investment, economic, or other

relationships maintained directly, indirectly, or on behalf of

third parties with the Company, its executive directors and

managers with strategic responsibilities, its controlling

companies or subsidiaries, or with parties otherwise related to