Chrysler 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341

|

|

Report on Operations Financial Review of the Group 33

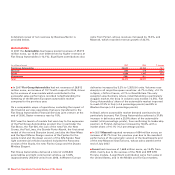

Agricultural and Construction Equipment

CNH - Case New Holland had revenues of 11,843 million euros.

The 12.5% increase from 2006 was negatively impacted by the

euro/dollar exchange rate; in US dollar terms, revenues

increased by 22.8%, as a result of higher volumes, improved

mix and prices, as well as new products.

In 2007 the global market for agricultural equipment grew by

2% over 2006. In North America demand for tractors and

combine harvesters rose by 2%. Increases in both product lines

were also recorded in Western Europe and in Latin America,

where demand for tractors and combine harvesters rose

sharply. In the Rest of the World markets, demand for tractors

decreased, against a very positive performance for combines.

All CNH brands gained market share, with particularly

significant improvements in combines and high horsepower

tractors.

In 2007, global deliveries of CNH agricultural equipment to the

dealer network and retail unit volumes increased in all

markets.

The global construction equipment market grew by 13% over

2006. Demand for both heavy and light equipment grew

significantly in all main regions apart from North America,

where it declined by 12%.

CNH construction equipment deliveries to the network and

retail unit sales increased overall, with strong growth in

Western Europe, Latin America and in the Rest of the World,

more than offsetting the decline, in line with the unfavourable

performance of the market, reported in North America.

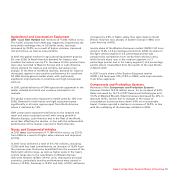

Trucks and Commercial Vehicles

In 2007 Iveco had revenues of 11,196 million euros, up 22.5%

from 2006 as a result of higher sales volumes and improved

pricing.

In 2007 Iveco delivered a total of 211,700 vehicles, including

13,300 with buy back commitments, an increase of 16.6% from

the previous year. Deliveries benefitted from the success of the

Daily light vehicle range, as well as higher sales in the heavy

vehicle range due to the new Stralis. In Western Europe

deliveries totalled 147,500 (+9.1%) units. Among the principal

countries, particularly positive performances were posted in

France (+12.9%), Germany (+12.4%) and Italy (+7.9%); deliveries

increased by 2.9% in Spain, while they were down in Great

Britain. Volumes rose sharply in Eastern Europe (+58%) and

Latin America (+45%).

Iveco’s share of the Western European market (GVW >_ 2.8 tons)

stood at 10.3% (-0.3 percentage points from 2006). Its share in

the light vehicle segment (-0.4 percentage points) was

penalised by competition from car-derived vehicles (vans),

while Iveco’s share rose in the medium segment (+0.7

percentage points) and in the heavy segment (+0.5 percentage

points) where it benefitted from the launch of the new Stralis

in March 2007.

In 2007 Iveco’s share of the Eastern European market

(GVW >_ 2.8 tons) was 13% (11.8% in 2006), with improvements

in all three segments.

Components and Production Systems

Revenues of the Components and Production Systems

business totalled 13,375 million euros, for an increase of 8.2%.

Sales increased by 15.1% at FPT Powertrain Technologies and

12.2% at Magneti Marelli. Teksid revenues decreased by 20% in

absolute terms, mainly due to changes in the scope of

consolidation (revenues were down 3.4% on a comparable

basis). Comau reported a decline in revenues of 14.9%, in line

with the reshaping of the business initiated in 2006.