Chrysler 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated

Financial Statements

Fiat Group Consolidated Financial Statements at December 31, 2007 - Notes100

Principal activities

Fiat S.p.A. is a corporation organised under the laws of the

Republic of Italy. Fiat S.p.A. and its subsidiaries (the “Group”)

operate in approximately 50 countries. The Group is engaged

principally in the manufacture and sale of automobiles,

agricultural and construction equipment and commercial vehicles.

It also manufactures other products and systems, principally

engines, transmission systems, automotive-related components,

metallurgical products and production systems. In addition, it is

involved in certain other sectors, including publishing and

communications, which represent a small portion of its activities.

The head office of the Group is located in Turin, Italy.

The consolidated financial statements are presented in euros,

the Group’s functional currency.

Significant accounting policies

Basis of preparation

The 2007 consolidated financial statements have been

prepared in accordance with the International Financial

Reporting Standards (the “IFRS”) issued by the International

Accounting Standards Board (“IASB”) and adopted by the

European Union, and with the provisions implementing article

9 of Legislative Decree no. 38/2005. The designation “IFRS”

also includes all valid International Accounting Standards

(“IAS”), as well as all interpretations of the International

Financial Reporting Interpretations Committee (“IFRIC”),

formerly the Standing Interpretations Committee (“SIC”).

The financial statements are prepared under the historical cost

convention, modified as required for the valuation of certain

financial instruments.

Format of the financial statements

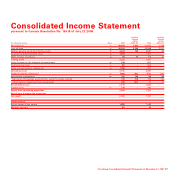

The Group presents an income statement using a classification

based on the function of expenses (otherwise known as the

“cost of sales” method), rather than based on their nature, as

this is believed to provide information that is more relevant.

The format selected is that used for managing the business

and for management reporting purposes and is consistent with

international practice in the automotive sector.

In this income statement, in which the classification of

expenses is based on their function, the result from trading

operations is reported specifically as part of the Operating

result and separate from the income and expense resulting

from the non-recurring operations of the business, such as

gains and losses on the sale of investments, restructuring costs

and any other unusual income or expense of a different nature.

By doing this, it is believed that the Group’s actual

performance from normal trading operations may be measured

in a better way, while disclosing specific details of unusual

income and expenses. Consequently, the definition of unusual

transaction adopted by the Group differs from that provided in

the Consob Communication of July 28, 2006, under which

unusual and abnormal transactions are those which, because

of their significance or importance, the nature of the parties

involved, the object of the transaction, the methods of

determining the transfer price or the timing of the event (close

to the year end), may give rise to doubts regarding the

accuracy/completeness of the information in the financial

statements, conflicts of interest, the safeguarding of an entity’s

assets or the protection of minority interests.

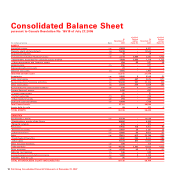

For the balance sheet, a mixed format has been selected to

present current and non-current assets and liabilities, as

permitted by IAS 1. In more detail, both companies carrying

out industrial activities and those carrying out financial

activities are consolidated in the Group’s financial statements,

including an entity performing banking activities (disposed of

in 2006 as described below). The investment portfolios of

financial services companies are included in current assets, as

the investments will be realised in their normal operating

cycle. Financial services companies, though, obtain funds only

partially from the market: the remaining are obtained from Fiat

S.p.A. through the Group’s treasury companies (included in

industrial companies), which lend funds both to industrial

Group companies and to financial services companies as the

need arises. This financial service structure within the Group

means that any attempt to separate current and non-current

debt in the consolidated balance sheet cannot be meaningful.

Suitable disclosure on the due dates of liabilities is moreover

provided in the notes.

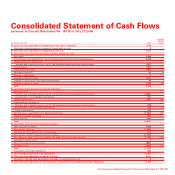

The Statement of Cash Flows is presented using the indirect

method.