Chrysler 2007 Annual Report Download - page 252

Download and view the complete annual report

Please find page 252 of the 2007 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Financial Statements

Fiat S.p.A. Financial Statements at December 31, 2007 - Notes to the Financial Statements 251

Principal activities

Fiat S.p.A. (the “Company”) is a corporation organised under

the laws of the Republic of Italy and is the Parent Company of

the Fiat Group, holding investments, either directly or indirectly

through sub-holdings, in the capital of the parent companies of

business Sectors in which the Fiat Group operates.

The head office of the company is in Turin, Italy.

The financial statements of Fiat S.p.A. are prepared in euros

which is the currency of the economic environment in which

the company operates.

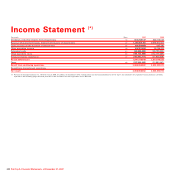

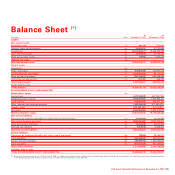

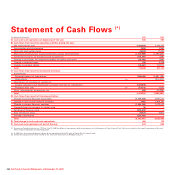

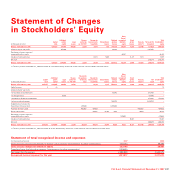

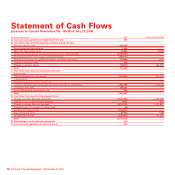

The Balance Sheet and Income Statement are presented in

euros, while the Statement of Cash Flows, the Statement of

Changes in Stockholders’ Equity, the Statement of Total

Recognised Income and Expenses and the amounts stated in

the Notes are presented in thousands of euros, unless

otherwise stated.

As the Parent Company, Fiat S.p.A. has additionally prepared

the consolidated financial statements of the Fiat Group at

December 31, 2007.

Significant accounting policies

Basis of preparation

The 2007 financial statements are the separate financial

statements of the Parent Company, Fiat S.p.A., and have been

prepared in accordance with the International Financial

Reporting Standards (“IFRS”) issued by the International

Accounting Standards Board (“IASB”) and adopted by the

European Union, as well as the provisions issued in

implementation of Article 9 of Legislative Decree no. 38/2005.

The designation “IFRS” also includes all the revised

International Accounting Standards (“IAS”) and all the

interpretations of the International Financial Reporting

Interpretations Committee (“IFRIC”), previously known as the

Standing Interpretations Committee (“SIC”).

In compliance with European Regulation no. 1606 of July 19,

2002, starting from 2005 the Fiat Group has adopted the

International Financial Reporting Standards (“IFRS”) issued by

the International Accounting Standards Board (“IASB”) for the

preparation of its consolidated financial statements. On the

basis of national legislation implementing that Regulation, the

annual statutory accounts of the Parent Company Fiat S.p.A. as

of December 31, 2006 have been prepared for the first time

also using those accounting standards. The information

required by IFRS 1

First-time Adoption of International

Financial Reporting Standards

relating to the effects of the

transition to IFRS was reported in an Appendix to the statutory

financial statements for the year ended December 31, 2006, to

which reference should be made.

The financial statements have been prepared on a historical

cost basis, modified as required for measuring certain financial

instruments.

Format of the financial statements

Fiat S.p.A. presents an Income Statement using a classification

based on the nature of its revenues and expenses given the

type of business it performs. The Fiat Group presents a

consolidated Income Statement using a classification based on

function, as this is believed to be more representative of the

format selected for managing the business sectors and for

internal reporting purposes and is coherent with international

practice in the automotive sector. Fiat S.p.A. has elected to

present current and non-current assets and liabilities as

separate classifications on the face of the Balance Sheet. A

mixed format has been selected by the Fiat Group for the

consolidated Balance Sheet, as permitted by IAS 1, presenting

only current and non-current assets separately. This decision

has been taken in view of the fact that both companies

carrying out industrial activities and those carrying out

financial services activities are consolidated in the Group’s

financial statements. The investment portfolios of financial

services companies are included in current assets in the

consolidated balance sheet, as the investments will be realised

in their normal operating cycle. Financial services companies,

though, obtain funds only partially from the market: the

remaining are obtained through the Group’s treasury

companies (included in industrial companies), which lend

funds both to industrial Group companies and to financial

services companies as the need arises.

This financial service structure within the Group means that

any attempt to separate current and non-current debt in the

consolidated Balance Sheet cannot be meaningful. This has no

effect on the presentation of the liabilities of Fiat S.p.A.