Chrysler 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341

|

|

Report on Operations Financial Review of the Group 37

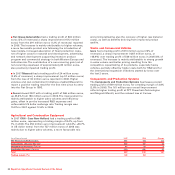

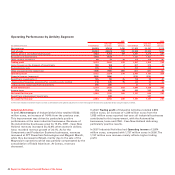

■In 2007, FPT Powertrain Technologies had a trading profit of

271 million euros, an increase of 103 million euros (+61.3%)

over 2006, resulting in an improvement in trading margin from

2.7% in 2006 to 3.8% in 2007. The improvement is mainly due

to efficiencies in the purchasing and manufacturing areas and

growth in volume, while higher costs for international business

development negatively impacted trading results.

■Magneti Marelli had a trading profit of 214 million euros, an

increase of 24 million euros compared to 2006. Higher sales

volumes and efficiency gains compensated price pressures,

increased raw material prices and industrial start-up costs for

new products. Trading margin was 4.3%, in line with 2006.

■Teksid closed 2007 with a trading profit of 47 million euros,

which was impacted by the trading loss of 9 million euros of

Teksid Aluminum, against a profit of 56 million euros in 2006,

which included the positive result of 16 million euros relating

to sold activities. On a comparable scope of operations, trading

profit improved by 16 million euros due to efficiency gains,

which more than offset higher energy and materials costs.

■Comau closed 2007 with a trading loss of 23 million euros

(reported in the first quarter of 2007 and followed by

substantial breakeven in the rest of the year), a substantial

improvement from the loss of 66 million euros reported in

2006. The improvement is the result of the reshaping plan

launched in the second half of 2006, the effects of which are

starting to be felt. The most important improvements were

reported by the Body-welding operations in Europe.

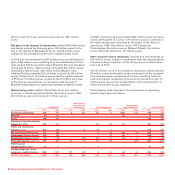

Other Businesses

The trading loss reported by the Other Businesses totalled 172

million euros, compared with a trading loss of 121 million

euros in 2006.

■In 2007, Itedi had a trading profit of 12 million euros (3.1% of

revenues), against a profit of 11 million euros in 2006 (2.7% of

revenues). The improvement is mainly attributable to general,

industrial and distribution cost-containment initiatives at

Editrice La Stampa (whose trading margin rose by 2

percentage points), notwithstanding higher amortization

connected to the new rotary press project and the termination

of government paper cost subsidies.

■The trading loss of Holding companies, Other companies and

Eliminations rose from 132 million euros in 2006 (which

included a profit of 37 million euros of the Services Sector) to

184 million euros in 2007. The change of 52 million euros is

attributable to lower volumes of activity for the “Treno Alta

Velocità” (T.A.V.) contract (in the first quarter of 2006 there

had still been significant income from the Turin-Novara line,

which was completed in that period), the change in the scope

of consolidation, in particular due to the disposal of B.U.C. -

Banca Unione di Credito, as well as higher non-cash costs

recognised in connection with stock option plans.

Operating result

In 2007 Operating income totalled 3,152 million euros, against

2,061 million euros in 2006. The 1,091 million euro

improvement from 2006 reflects higher trading profit for

1,282 million euros, partially reduced by lower unusual

income for 191 million euros. The latter is the effect of lower

gains on the disposal of investments for 417 million euros,

higher other net unusual expenses for 119 million euros,

(in millions of euros) 2007 2006 Change

Publishing and Communications (Itedi) 12 11 1

Holding companies, Other companies and Eliminations (184) (132) -52

Total (172) (121) -51