CarMax 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

CARMAX 2006

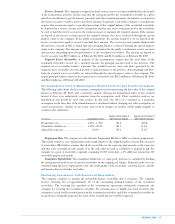

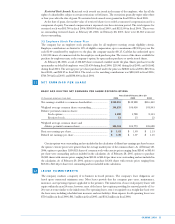

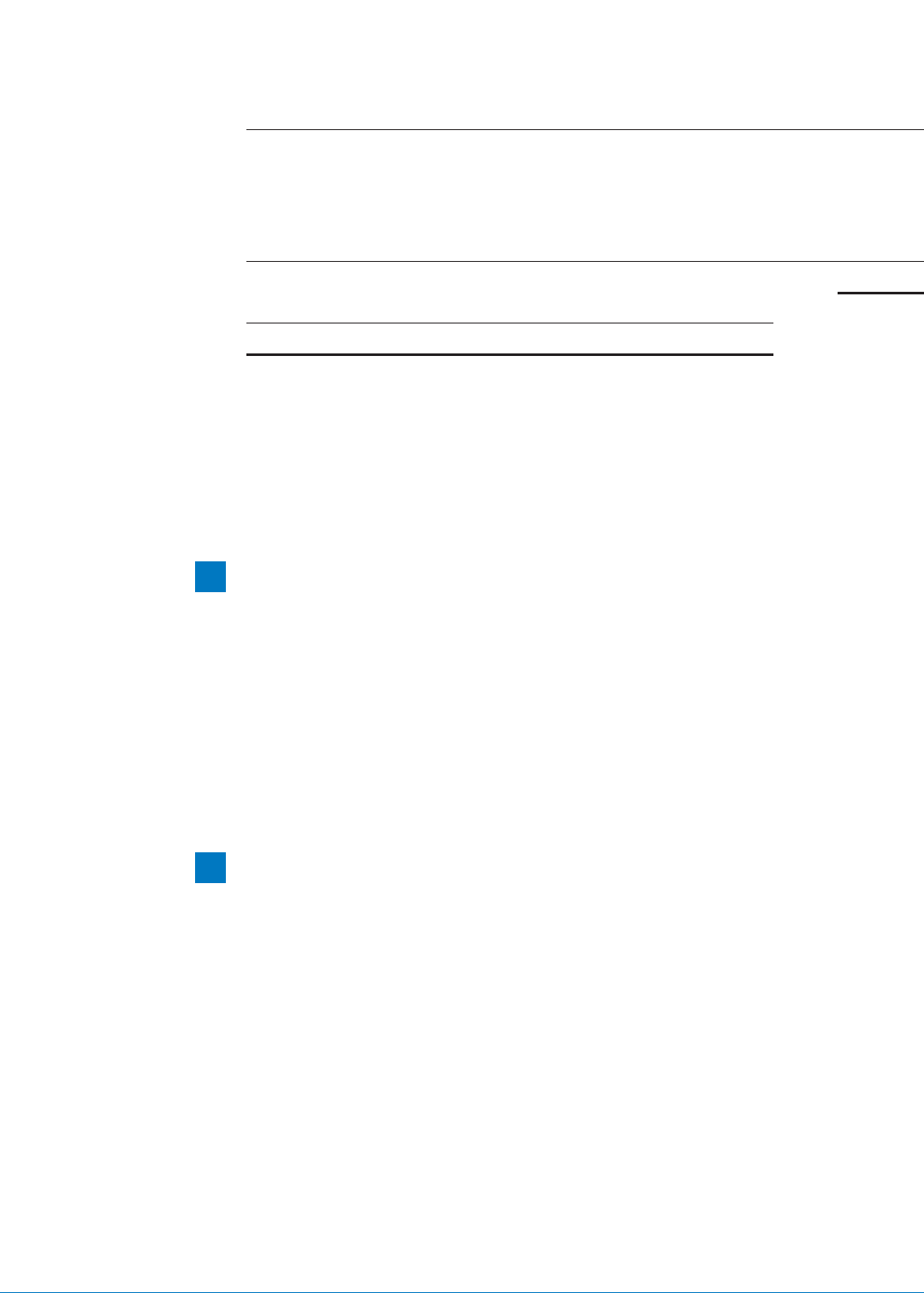

FUTURE MINIMUM FIXED LEASE OBLIGATIONS

As of February 28, 2006

Capital Operating

(In thousands) Leases (1) Leases (1)

Fiscal 2007.................................................................................................... $ 4,453 $ 68,597

Fiscal 2008.................................................................................................... 4,453 68,976

Fiscal 2009.................................................................................................... 4,462 69,665

Fiscal 2010.................................................................................................... 4,627 70,371

Fiscal 2011.................................................................................................... 4,777 70,687

Fiscal 2012 and thereafter ........................................................................... 48,690 633,944

Total minimum lease payments .................................................................. 71,462 $982,240

Less amounts representing interest............................................................. (35,713)

Present value of net minimum capital lease payments [Note 9] ................... $35,749

(1) Future minimum fixed lease obligations exclude taxes, insurance, and other costs payable directly by the company.

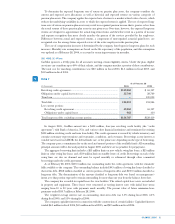

The company entered into sale-leaseback transactions involving five superstores valued at approximately

$72.7 million in fiscal 2006, and sale-leaseback transactions for seven superstores valued at approximately $84.0

million in fiscal 2005. All sale-leaseback transactions are structured at competitive rates. Gains or losses on sale-

leaseback transactions are recorded as deferred rent and amortized over the lease term. The company does not

have continuing involvement under the sale-leaseback transactions. In conjunction with certain sale-leaseback

transactions, the company must meet financial covenants relating to minimum tangible net worth and minimum

coverage of rent expense. The company was in compliance with all such covenants at February 28, 2006.

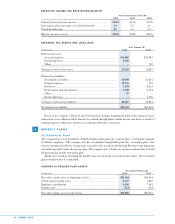

SUPPLEMENTAL FINANCIAL STATEMENT INFORMATION

(A) Goodwill and Other Intangibles

Other assets on the consolidated balance sheets included goodwill and other intangibles with a carrying value

of $15.0 million as of February 28, 2006, and February 28, 2005.

(B) Accrued Compensation and Benefits

Accrued expenses and other current liabilities on the consolidated balance sheets included accrued

compensation and benefits of $75.8 million as of February 28, 2006, and $53.8 million as of February 28, 2005.

(C) Advertising Expense

Selling, general, and administrative expenses on the consolidated statements of earnings included advertising

expense of $86.7 million in fiscal 2006, $73.6 million in fiscal 2005, and $62.4 million in fiscal 2004.

Advertising expenses were 1.4% of net sales and operating revenues for fiscal 2006, fiscal 2005, and fiscal 2004.

CONTINGENT LIABILITIES

(A) Litigation

In the normal course of business, the company is involved in various legal proceedings. Based upon the

company’s evaluation of the information presently available, management believes that the ultimate resolution

of any such proceedings will not have a material adverse effect on the company’s financial position, liquidity, or

results of operations.

(B) Other Matters

In accordance with the terms of real estate lease agreements, the company generally agrees to indemnify the

lessor from certain liabilities arising as a result of the use of the leased premises, including environmental

liabilities and repairs to leased property upon termination of the lease. Additionally, in accordance with the

terms of agreements entered into for the sale of properties, the company generally agrees to indemnify the

buyer from certain liabilities and costs arising subsequent to the date of the sale, including environmental

liabilities and liabilities resulting from the breach of representations or warranties made in accordance with the

agreements. The company does not have any known material environmental commitments, contingencies, or

other indemnification issues arising from these arrangements.

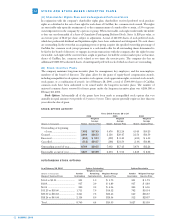

13

14