CarMax 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

CARMAX 2006

MANAGEMENT’S DISCUSSION AND ANALYSIS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations

(“MD&A”) is intended to help the reader understand the financial performance of CarMax, Inc. MD&A is

presented in eight sections: Business Overview; Critical Accounting Policies; Results of Operations;

Operations Outlook; Recent Accounting Pronouncements; Financial Condition; Market Risk; and

Cautionary Information About Forward-Looking Statements. MD&A is provided as a supplement to, and

should be read in conjunction with, our consolidated financial statements and the accompanying notes

contained elsewhere in this annual report.

In MD&A, “we,” “our,” “us,” “CarMax,” “CarMax, Inc.,” and “the company” refer to CarMax, Inc. and its

wholly owned subsidiaries, unless the context requires otherwise. Amounts and percentages in tables may not

total due to rounding.

BUSINESS OVERVIEW

General

CarMax is the nation’s largest retailer of used vehicles. We pioneered the used car superstore concept, opening

our first store in 1993. Over the next six years, we opened an additional 32 used car superstores before

suspending new store development to focus on improving sales and profits. After a period of concept refinement

and execution improvement, we resumed opening new stores at the end of fiscal 2002. At February 28, 2006,

we had 67 used car superstores in 31 markets, including 23 mid-sized markets and 8 large markets. We initially

defined mid-sized markets as those with television viewing populations generally between 1 million and

2.5 million people. As we have refined our operations and market data, we now believe a more appropriate

definition of a mid-sized market is one with a television viewing population generally between 600,000 and

2.5 million people. During fiscal 2006, we also operated seven new car franchises, all of which were integrated

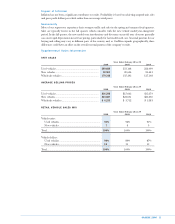

or co-located with our used car superstores. In fiscal 2006, we sold 289,888 used cars, representing 93% of the

total 310,789 vehicles the company sold at retail.

We believe the CarMax consumer offer is unique in the automobile retailing marketplace. Our offer gives

consumers a way to shop for cars in the same manner that they shop for items at other “big box” retailers. Our

consumer offer is structured around four core equities: low, no-haggle prices; a broad selection; high quality;

and customer-friendly service. Our website, carmax.com, is a valuable tool for communicating the CarMax

consumer offer, a sophisticated search engine, and an efficient sales channel for customers who prefer to

complete part of the shopping and sales process online. We generate revenues, income, and cash flows

primarily by retailing used vehicles and associated items including vehicle financing, extended service plans,

and vehicle repair service. A majority of the used vehicles we sell at retail are purchased directly from

consumers. Vehicles purchased through our appraisal process that do not meet our retail standards are sold at

on-site wholesale auctions.

Wholesale auctions are conducted at the majority of our superstores and are held on a weekly, bi-weekly, or

monthly basis. On average, the vehicles we wholesale are approximately 10 years old and have more than

100,000 miles. Participation in our wholesale auctions is restricted to licensed automobile dealers, the majority

of whom are independent dealers.

CarMax provides prime-rated financing to qualified customers through CarMax Auto Finance (“CAF”),

the company’s finance operation, and Bank of America. Nonprime financing is provided through several third-

party lenders, and subprime financing is provided through a third-party lender under a program rolled out

near the end of the second quarter of fiscal 2005. We periodically test additional third-party lenders. CarMax

has no recourse liability for loans provided by third-party lenders. Having our own finance operation allows us

to limit the risk of relying on third-party finance sources, while also allowing us to capture additional profit and

cash flows. The majority of CAF’s profit contribution is generated by the spread between the interest rates

charged to customers and our cost of funds. We collect fixed, prenegotiated fees from the third parties that

finance prime- and nonprime-rated customers. As is customary in the subprime finance industry, the subprime

lender purchases the loans at a discount.