CarMax 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

CARMAX 2006

BUSINESS AND BACKGROUND

CarMax, Inc. (“CarMax” and “the company”), including its wholly owned subsidiaries, is the largest retailer of

used vehicles in the United States. CarMax was the first used vehicle retailer to offer a large selection of quality

used vehicles at low, “no-haggle” prices using a customer-friendly sales process in an attractive, modern sales

facility. CarMax also sells new vehicles under various franchise agreements. CarMax provides its customers

with a full range of related services, including the financing of vehicle purchases through its own finance

operation, CarMax Auto Finance (“CAF”), and third-party lenders; the sale of extended service plans; the

appraisal and purchase of vehicles directly from consumers; and vehicle repair service. Vehicles purchased

through the appraisal process that do not meet CarMax’s retail standards are sold at on-site wholesale auctions.

CarMax was formerly a subsidiary of Circuit City Stores, Inc. (“Circuit City”). On October 1, 2002, the

CarMax business was separated from Circuit City through a tax-free transaction. As a result of the separation,

all of the businesses, assets, and liabilities of the CarMax business are held in CarMax, Inc., an independent,

separately traded public company.

At the separation date, Circuit City and CarMax executed a transition services agreement and a tax

allocation agreement. At the end of fiscal 2006, the only significant service provided by Circuit City to

CarMax under the transition services agreement pertained to the operation of the company’s data center.

The tax allocation agreement provided that the preseparation taxes attributable to the business of each party

would be borne solely by that party.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(A) Basis of Presentation and Use of Estimates

The consolidated financial statements include the accounts of CarMax and its wholly owned subsidiaries.

All significant intercompany balances and transactions have been eliminated in consolidation.

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets, liabilities, revenues, and expenses, and the disclosure of contingent assets and liabilities.

Actual results could differ from those estimates.

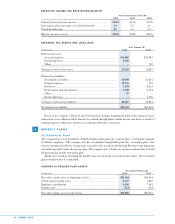

(B) Cash and Cash Equivalents

Cash equivalents of $6.0 million at February 28, 2006, and February 28, 2005, consisted of highly liquid

investments with original maturities of three months or less.

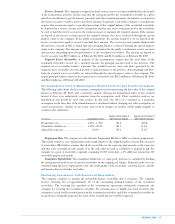

(C) Securitizations

The transfers of receivables associated with the company’s automobile loan securitization program are

accounted for as sales in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 140,

“Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities.” The company

retains an interest in the automobile loan receivables that it securitizes. The retained interest presented on the

company’s consolidated balance sheets includes the present value of the expected residual cash flows generated

by the securitized receivables, various reserve accounts, and an undivided ownership interest in securitized

receivables. The retained interest is carried at fair value, and changes in fair value are included in earnings. See

Notes 3 and 4 for additional discussion of securitizations.

(D) Fair Value of Financial Instruments

Due to the short-term nature and/or variable rates associated with these financial instruments, the carrying

value of the company’s cash and cash equivalents, receivables including automobile loan receivables,

accounts payable, short-term debt, and long-term debt approximates fair value. The company’s retained

interest in securitized receivables and derivative financial instruments are recorded on the consolidated

balance sheets at fair value.

(E) Trade Accounts Receivable

Trade accounts receivable, net of an allowance for doubtful accounts, include certain amounts due from

finance companies and customers, as well as from manufacturers for incentives and warranty

reimbursements, and for other miscellaneous receivables. The estimate for doubtful accounts is based on

historical experience and trends.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1

2