CarMax 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2006

31

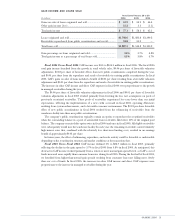

Income Taxes

The effective income tax rate was 38.3% in fiscal 2006, 38.8% in fiscal 2005, and 38.5% in fiscal 2004. The

fiscal 2006 decrease resulted primarily from a legal entity reorganization in the fourth quarter of fiscal 2005.

The company created a centralized corporate management entity in an effort to obtain operational, legal, and

other benefits that also resulted in state tax efficiencies. The fiscal 2005 increase resulted from geographic

expansion into states with higher income tax rates, including having a larger percentage of stores located in

unitary tax states.

OPERATIONS OUTLOOK

Store Openings and Capital Expenditures

During the fiscal year ending February 28, 2007, we plan to expand our used car superstore base by

approximately 16%, opening approximately 11 used car superstores, consisting of an approximately equal mix

of standard and satellite superstores.

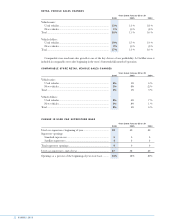

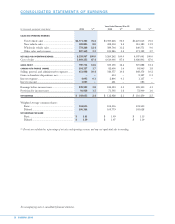

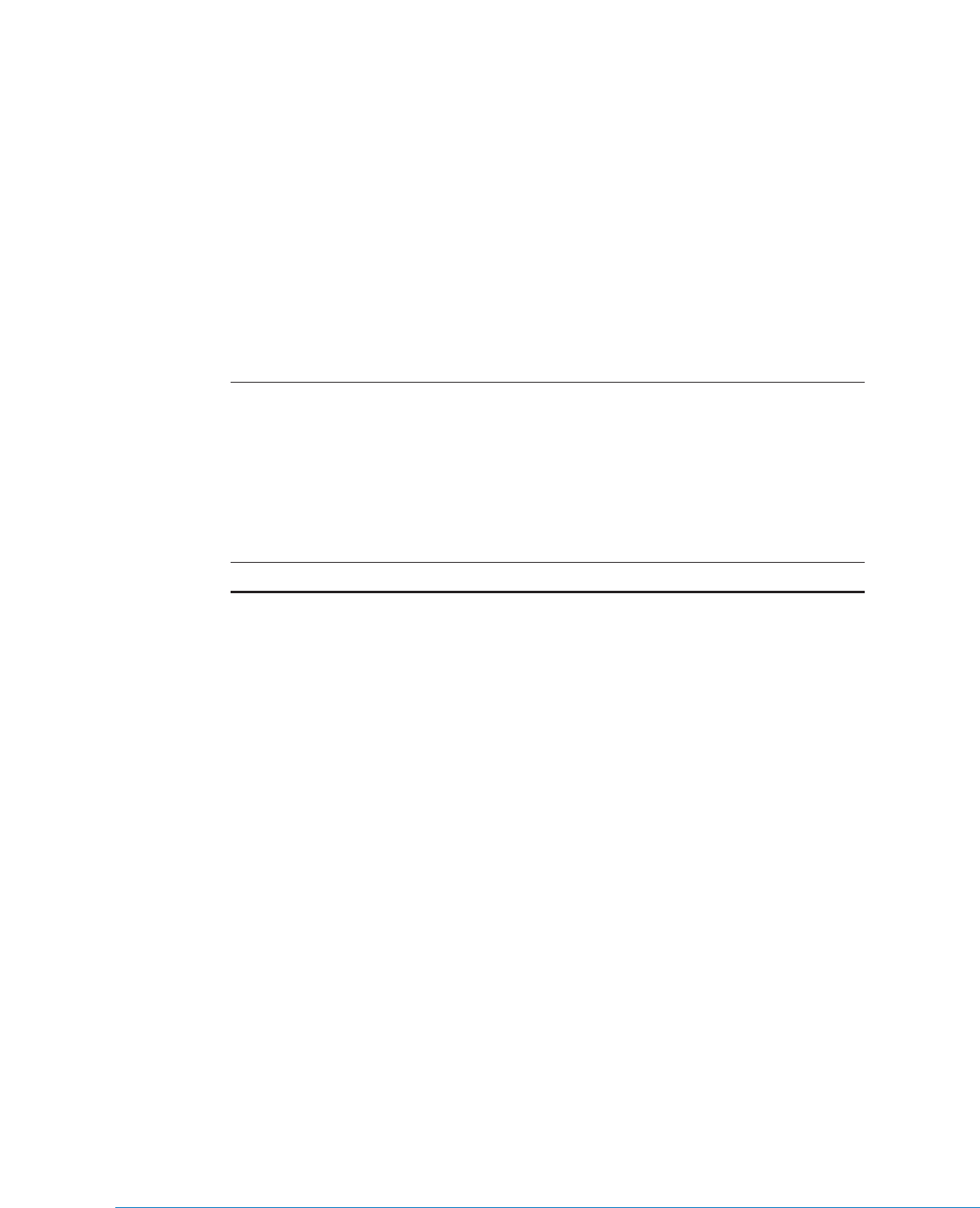

FISCAL 2007 PLANNED SUPERSTORE OPENINGS

Standard Satellite Total

Superstores Superstores Superstores

Hartford/New Haven, Conn. .... New mid-sized market ...................... 1 1 2

Columbus, Ohio ........................ New mid-sized market ...................... 1 1 2

Oklahoma City, Okla. ............... New mid-sized market ...................... 1 — 1

Los Angeles, Calif...................... Existing large market ........................ — 1 1

Charlottesville, Va...................... New small market ............................. — 1 1

Fredericksburg, Va.(1) .................. Existing large market ........................ 1 — 1

Austin, Tex. ................................ Existing mid-sized market................. — 1 1

Charlotte, N.C. .......................... Existing mid-sized market................. 1 — 1

Fresno, Calif. .............................. New mid-sized market ...................... 1 — 1

Total planned openings............................................................................. 6 5 11

(1) Part of the Washington, D.C. television market.

We expect to open approximately four stores in the first quarter of fiscal 2007, two stores late in the third

quarter, and five stores in the fourth quarter. Given their timing, we expect little, if any, contribution to fiscal

2007 sales and profits from the stores scheduled to open in the fourth quarter. In addition, normal construction,

permitting, or other scheduling delays could shift the opening dates of any of these stores into fiscal 2008.

With an estimated television viewing population of approximately 185,000, Charlottesville, Va., represents

our first entry into a small market. We will be adjusting our store footprint, inventory, and our staffing model in

this store, as a result of the smaller overall sales opportunities provided by this market. This store’s performance

over the next few years will help us better understand our longer-term opportunities in small markets.

In May 2006, we opened our first “CarMax Car Buying Center,” which is in the Atlanta market in a major

automotive retail center not currently served by CarMax. The store is staffed with CarMax buyers, who

conduct appraisals and purchase vehicles on site using the same processes and systems utilized in our used car

superstores. We do not sell cars at this store. This test store is part of our long-term program to increase both

appraisal traffic and retail vehicle sourcing self-sufficiency.

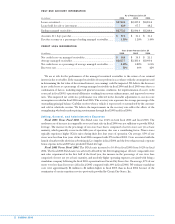

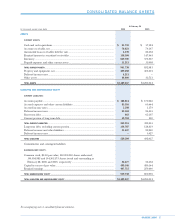

We estimate gross capital expenditures will total approximately $300 million in fiscal 2007. Planned

expenditures primarily relate to new store construction and land purchases associated with future year store

openings. Compared with fiscal 2006, the increase in estimated fiscal 2007 capital spending primarily reflects

a higher level of real estate purchases for store development in future years, as well as the timing of

construction activities.