CarMax 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2006

51

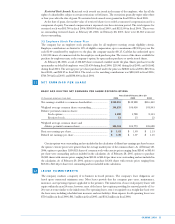

To determine the expected long-term rate of return on pension plan assets, the company considers the

current and expected asset allocations, as well as historical and expected returns on various categories of

pension plan assets. The company applies the expected rate of return to a market-related value of assets, which

reduces the underlying variability in assets to which the expected return is applied. The use of expected long-

term rates of return on pension plan assets may result in recognized pension income that is greater or less than

the actual returns of those pension plan assets in any given year. Over time, however, the expected long-term

returns are designed to approximate the actual long-term returns and therefore result in a pattern of income

and expense recognition that more closely matches the pattern of the services provided by the employees.

Differences between actual and expected returns, a component of unrecognized actuarial gains/losses, are

recognized over the average future expected service of the active employees in the pension plan.

The rate of compensation increases is determined by the company, based upon its long-term plans for such

increases. Mortality rate assumptions are based on the life expectancy of the population, and this assumption

was updated as of February 28, 2006, to account for recent improvements in mortality.

(B) 401(k) Plan

CarMax sponsors a 401(k) plan for all associates meeting certain eligibility criteria. Under the plan, eligible

associates can contribute up to 40% of their salaries, and the company matches a portion of those contributions.

The total cost for matching contributions was $2.0 million in fiscal 2006, $1.5 million in fiscal 2005, and

$1.2 million in fiscal 2004.

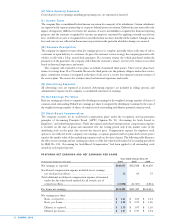

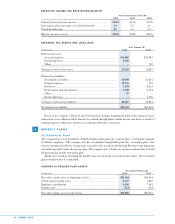

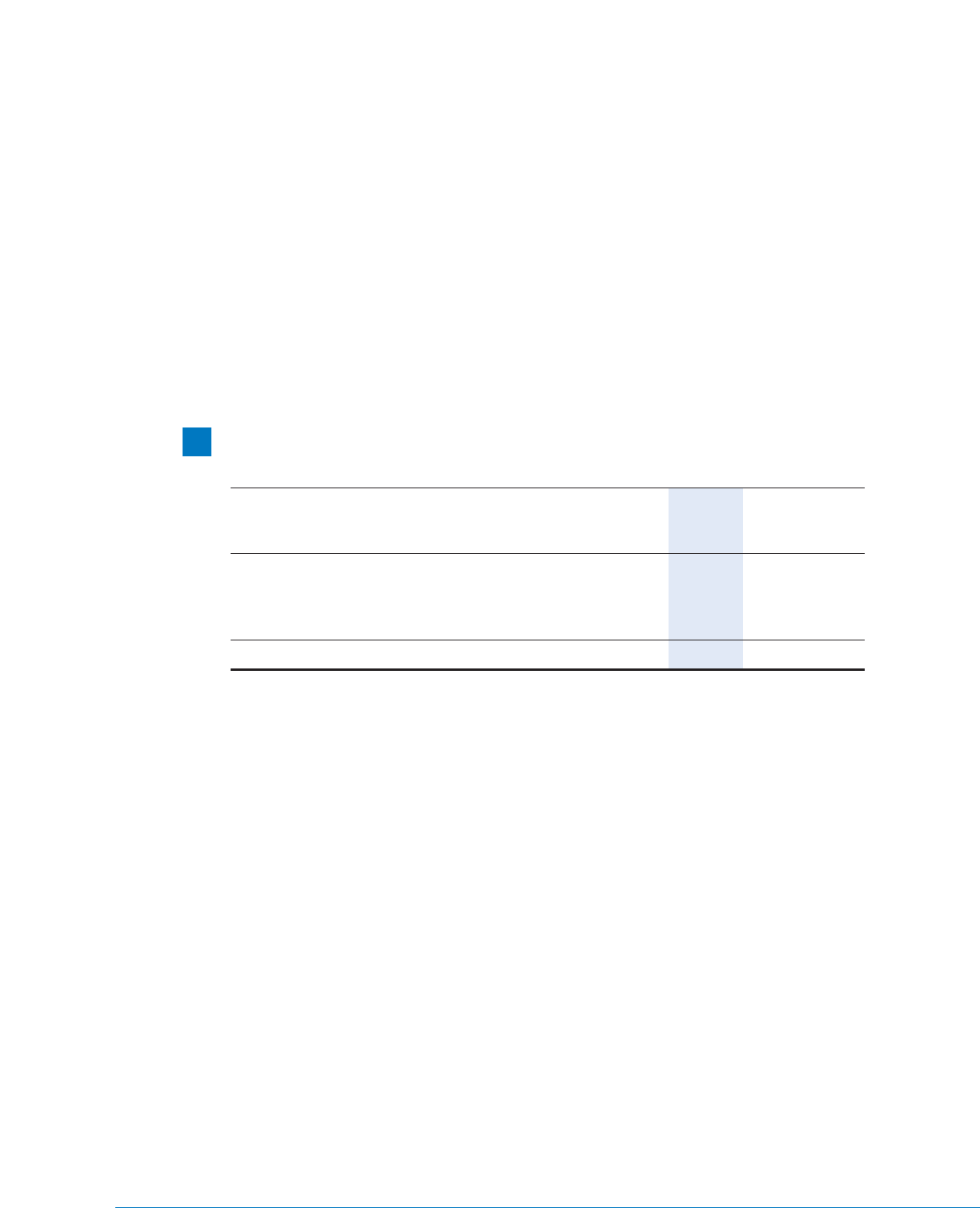

DEBT

As of February 28

(In thousands) 2006 2005

Revolving credit agreement ......................................................................... $159,263 $ 65,197

Obligations under capital leases [Note 12] ...................................................... 35,749 28,749

Term loan...................................................................................................... —100,000

Total debt...................................................................................................... 195,012 193,946

Less current portion:

Revolving credit agreement.................................................................... 59,263 65,197

Obligations under capital leases ............................................................. 962 330

Total long-term debt, excluding current portion ........................................ $134,787 $128,419

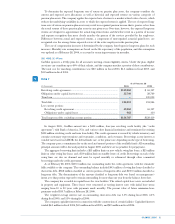

In August 2005, CarMax entered into a $450 million, four-year revolving credit facility (the “credit

agreement”) with Bank of America, N.A. and various other financial institutions and terminated its existing

$300 million revolving credit and term loan facility. The credit agreement is secured by vehicle inventory and

contains customary representations and warranties, conditions, and covenants. Borrowings accrue interest at

variable rates based on LIBOR, the federal funds rate, or the prime rate, depending on the type of borrowing.

The company pays a commitment fee on the used and unused portions of the available funds. All outstanding

principal amounts will be due and payable in August 2009, and there are no penalties for prepayment.

The aggregate borrowing limit includes a $25 million limit on new vehicle swing line loans, a $25 million

limit on other swing line loans, and a $30 million limit on standby letters of credit. Borrowings on each of the

swing lines are due on demand and must be repaid monthly or refinanced through other committed

borrowings under the credit agreement.

As of February 28, 2006, $159.3 million was outstanding under the credit agreement, with the remainder

fully available to the company. The outstanding balance included $0.5 million of swing line loans classified as

short-term debt, $58.8 million classified as current portion of long-term debt, and $100.0 million classified as

long-term debt. The determination of the amount classified as long-term debt was based on management’s

intent as to that portion expected to remain outstanding for more than one year from the balance sheet date.

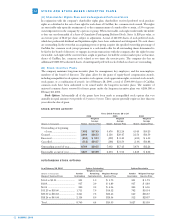

The company has recorded six capital leases for store facilities. The related capital lease assets are included

in property and equipment. These leases were structured at varying interest rates with initial lease terms

ranging from 10 to 20 years with payments made monthly. The present value of future minimum lease

payments totaled $35.7 million at February 28, 2006.

The weighted average interest rate on outstanding short-term debt was 5.5% during fiscal 2006, 4.3%

during fiscal 2005, and 3.5% during fiscal 2004.

The company capitalizes interest in connection with the construction of certain facilities. Capitalized interest

totaled $6.0 million in fiscal 2006, $3.5 million in fiscal 2005, and $2.5 million in fiscal 2004.

9