CarMax 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2006

33

FINANCIAL CONDITION

Operating Activities

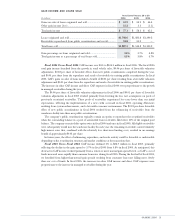

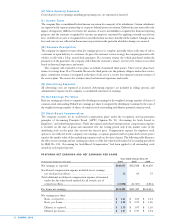

We generated net cash from operating activities of $122.3 million in fiscal 2006, $45.7 million in fiscal 2005,

and $147.0 million in fiscal 2004. The $76.6 million improvement in cash generated from operating activities in

fiscal 2006 compared with fiscal 2005 primarily reflected the $35.2 million increase in net earnings and a $39.9

million reduction in the year-over-year growth in current assets other than cash. The increase in inventories in

both years reflected the growth in total vehicle inventories resulting from the expansion of our store base. The

$101.2 million decline in cash generated from operating activities in fiscal 2005 compared with fiscal 2004

primarily reflected a $110.9 million increase in the year-over-year growth in inventories. Inventory levels were

similar at the beginning and the end of fiscal 2004, reflecting a higher-than-normal inventory balance at the

beginning of the year and the disposal of four new car franchises, which together offset the growth in inventory

associated with store openings.

The aggregate principal amount of automobile loan receivables funded through securitizations, which

are discussed in Notes 3 and 4 to the company’s consolidated financial statements, totaled $2.71 billion at

February 28, 2006, $2.43 billion at February 28, 2005, and $2.20 billion at February 29, 2004. During fiscal

2006, we completed three public automobile securitizations totaling $1.59 billion. At February 28, 2006, the

warehouse facility limit was $825.0 million and unused warehouse capacity totaled $241.0 million. The

warehouse facility matures in July 2006. Note 4 to the company’s consolidated financial statements includes

a discussion of the warehouse facility. We anticipate that we will be able to renew, expand, or enter into new

securitization arrangements to meet the future needs of the automobile finance operation.

Investing Activities

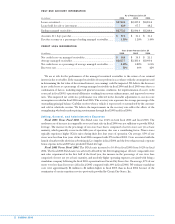

Net cash used in investing activities was $116.1 million in fiscal 2006, $141.1 million in fiscal 2005, and $73.8

million in fiscal 2004. Capital expenditures were $194.4 million in fiscal 2006, $230.1 million in fiscal 2005,

and $181.3 million in fiscal 2004. In addition to store construction costs, capital expenditures for all three years

included the cost of land acquired for future year store openings and costs associated with our new home

office, which was completed in October 2005. Compared with fiscal 2005, the decline in capital spending in

fiscal 2006 primarily reflects fewer real estate purchases for store development in future years. Several of the

store sites added in fiscal 2006 were acquired pursuant to long-term leases, as opposed to purchases.

Capital expenditures are funded through internally generated funds, short- and long-term debt, and sale-

leaseback transactions. Net proceeds from the sales of assets totaled $78.3 million in fiscal 2006, $89.0 million

in fiscal 2005, and $107.5 million in fiscal 2004. The majority of the sale proceeds relate to sale-leaseback

transactions. In fiscal 2006, we entered into sale-leaseback transactions involving five superstores valued at

$72.7 million. In fiscal 2005, we entered into sale-leaseback transactions involving seven superstores valued at

approximately $84.0 million. In fiscal 2004, we entered into sale-leaseback transactions involving nine

superstores valued at approximately $107.0 million. These transactions were structured with initial lease terms

of either 15 or 20 years with four, five-year renewal options. At February 28, 2006, we owned ten superstores

currently in operation, as well as the company’s home office in Richmond, Virginia. In addition, six store

facilities were accounted for as capital leases.

Financing Activities

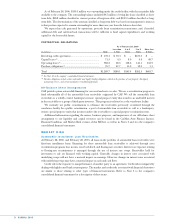

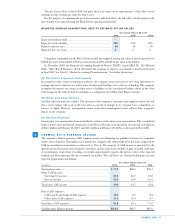

Net cash used in financing activities was $1.6 million in fiscal 2006, while net cash provided by financing

activities was $63.8 million in fiscal 2005. In fiscal 2004, net cash used in financing activities was $47.6 million.

In fiscal 2006, we used cash generated from operations to reduce total debt by $6.8 million. In fiscal 2005, we

increased total debt by $60.2 million primarily to fund increased inventory. In fiscal 2004, we used cash

generated from operations to reduce total outstanding debt by $51.6 million.

In August 2005, we entered into a new, four-year $450 million revolving credit facility secured by vehicle

inventory. Concurrently, we terminated our existing $300 million credit agreement. Borrowings under the new

credit facility are available for working capital and general corporate purposes, and represent senior secured

indebtedness of the company. All outstanding principal amounts borrowed under the credit facility will be due

and payable in August 2009. The aggregate borrowing limit includes a $25 million limit on new vehicle swing

line loans, a $25 million limit on other swing line loans, and a $30 million limit on standby letters of credit.

Borrowings on each of the swing lines are due on demand and must be repaid monthly or refinanced through

other committed borrowings under the credit agreement.