CarMax 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2006

35

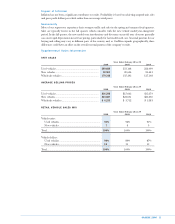

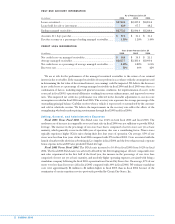

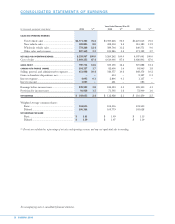

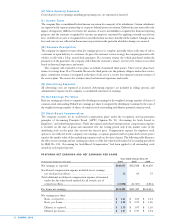

COMPOSITION OF AUTOMOBILE LOAN RECEIVABLES

As of February 28

(In millions) 2006 2005

Principal amount of:

Fixed-rate securitizations.......................................................................... $2,126.4 $1,764.7

Floating-rate securitizations synthetically altered to fixed...................... 584.0 662.1

Floating-rate securitizations ..................................................................... —0.4

Held for investment (1) .............................................................................. 57.9 45.5

Held for sale (2).......................................................................................... 4.1 22.2

Total ............................................................................................................. $2,772.5 $2,494.9

(1) The majority is held by a bankruptcy-remote special purpose entity.

(2) Held by a bankruptcy-remote special purpose entity.

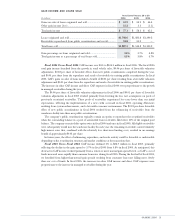

Interest Rate Exposure

We also have interest rate risk from changing interest rates related to our outstanding debt. Substantially all of

the debt is floating-rate debt based on LIBOR. A 100-basis point increase in market interest rates would have

decreased our fiscal 2006 net earnings per share by less than $0.01.

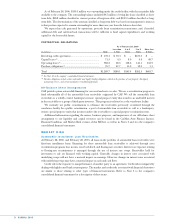

CAUTIONARY INFORMATION ABOUT FORWARD-LOOKING STATEMENTS

The company cautions readers that the statements contained herein regarding the company’s future business

plans, operations, opportunities, or prospects, including without limitation any statements or factors regarding

management’s expectations for fiscal 2007 and beyond, are forward-looking statements made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking

statements are based upon management’s current knowledge and assumptions about future events and involve

risks and uncertainties that could cause actual results to differ materially from anticipated results. Among the

factors that could cause actual results and outcomes to differ materially from those contained in the forward-

looking statements are the following: changes in the general U.S. or regional U.S. economy; intense

competition within the company’s industry; significant changes in retail prices for used and new vehicles; a

reduction in the availability or the company’s access to sources of inventory; the significant loss of key

employees from the company’s store, regional, and corporate management teams; the efficient operation of the

company’s information systems; changes in the availability or cost of capital and working capital financing; the

company’s ability to acquire suitable real estate; the occurrence of adverse weather events; seasonal

fluctuations in the company’s business; the geographic concentration of the company’s superstores; the

regulatory environment in which the company operates; the effect of various litigation matters; the effect of

new accounting requirements or changes to generally accepted accounting principles; and the occurrence of

certain other material events. For more details on factors that could affect expectations, see the company’s

Annual Report on Form 10-K for the fiscal year ended February 28, 2006, and its quarterly or current reports

as filed with or furnished to the Securities and Exchange Commission.