CarMax 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2006

53

Restricted Stock Awards. Restricted stock awards are issued in the name of the employee, who has all the

rights of a shareholder, subject to certain restrictions or forfeitures. The restrictions generally expire either three

or four years after the date of grant. No restricted stock awards were granted in fiscal 2006 or fiscal 2005.

At the date of grant, the market value of restricted shares is recorded as unearned compensation and is a

component of equity. Unearned compensation is expensed over the restriction period. The total expense for

restricted stock was $53,700 in fiscal 2006; $108,000 in fiscal 2005; and $121,500 in fiscal 2004. There were

no outstanding restricted shares at February 28, 2006. At February 28, 2005, there were 23,918 restricted

shares outstanding.

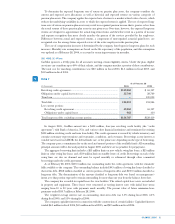

(C) Employee Stock Purchase Plan

The company has an employee stock purchase plan for all employees meeting certain eligibility criteria.

Employee contributions are limited to 10% of eligible compensation, up to a maximum of $7,500 per year. For

each $1.00 contributed by employees to the plan, the company matches $0.15. CarMax has authorized up to

1,000,000 shares of common stock for the employee stock purchase plan. The source of the shares available for

purchase by employees may, at the company’s option, be open market purchases or newly issued shares.

At February 28, 2006, a total of 302,227 shares remained available under the plan. Shares purchased on the

open market on behalf of employees were 213,659 during fiscal 2006; 225,961 during fiscal 2005; and 161,662

during fiscal 2004. The average price per share purchased under the plan was $28.83 in fiscal 2006, $25.96 in

fiscal 2005, and $29.97 in fiscal 2004. The total cost for matching contributions was $803,600 in fiscal 2006;

$746,700 in fiscal 2005; and $598,600 in fiscal 2004.

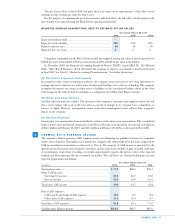

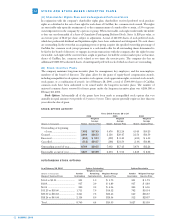

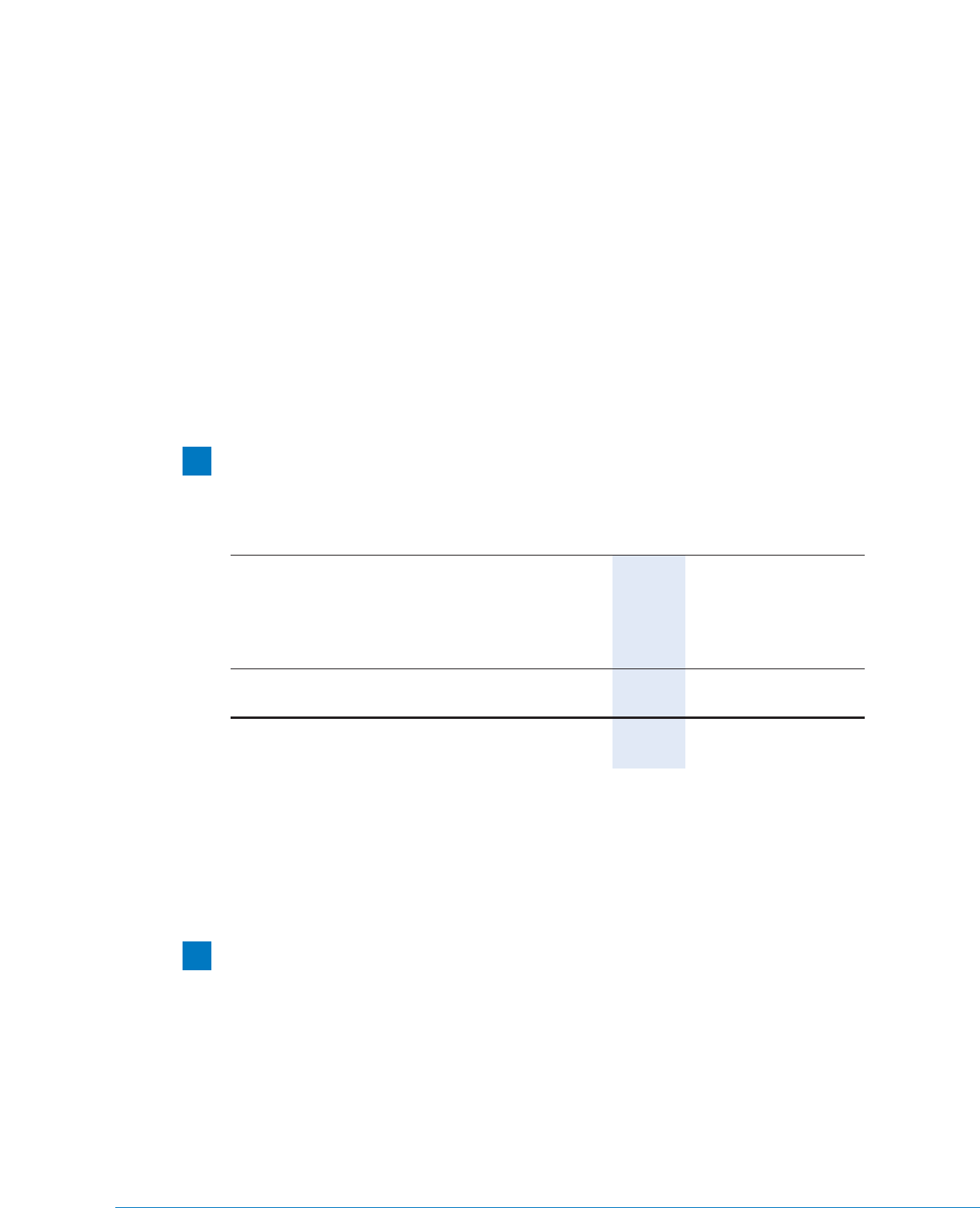

NET EARNINGS PER SHARE

BASIC AND DILUTIVE NET EARNINGS PER SHARE RECONCILIATIONS

Years Ended February 28 or 29

(In thousands except per share data) 2006 2005 2004

Net earnings available to common shareholders........................ $148,055 $112,928 $116,450

Weighted average common shares outstanding.......................... 104,635 104,036 103,503

Dilutive potential common shares:

Stock options ..................................................................... 1,698 1,728 2,113

Restricted stock.................................................................. 11 15 12

Weighted average common shares and

dilutive potential common shares .......................................... 106,344 105,779 105,628

Basic net earnings per share ........................................................ $ 1.41 $ 1.09 $ 1.13

Diluted net earnings per share .................................................... $ 1.39 $ 1.07 $ 1.10

Certain options were outstanding and not included in the calculation of diluted net earnings per share because

the options’ exercise prices were greater than the average market price of the common shares. As of February 28,

2006, options to purchase 1,890,921 shares of common stock with exercise prices ranging from $29.61 to $43.44

per share were outstanding and not included in the calculation. As of February 28, 2005, options to purchase

26,580 shares with exercise prices ranging from $30.34 to $43.44 per share were outstanding and not included in

the calculation. As of February 29, 2004, options to purchase 18,364 shares with exercise prices ranging from

$35.23 to $43.44 per share were outstanding and not included in the calculation.

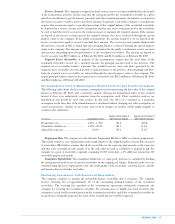

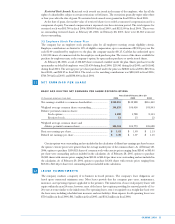

LEASE COMMITMENTS

The company conducts a majority of its business in leased premises. The company’s lease obligations are

based upon contractual minimum rates. Most leases provide that the company pays taxes, maintenance,

insurance, and operating expenses applicable to the premises. The initial term of most real property leases will

expire within the next 20 years; however, most of the leases have options providing for renewal periods of 5 to

20 years at terms similar to the initial terms. For operating leases, rent is recognized on a straight-line basis over

the lease term, including scheduled rent increases and rent holidays. Rent expense for all operating leases was

$72.6 million in fiscal 2006, $61.5 million in fiscal 2005, and $54.2 million in fiscal 2004.

12

11