CarMax 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

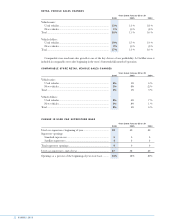

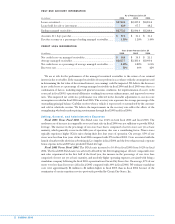

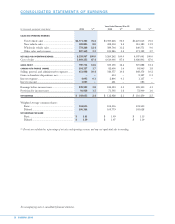

PAST DUE ACCOUNT INFORMATION

As of February 28 or 29

(In millions) 2006 2005 2004

Loans securitized................................................................................... $2,710.4 $2,427.2 $2,200.4

Loans held for sale or investment........................................................ 62.0 67.7 48.2

Ending managed receivables ................................................................ $2,772.5 $2,494.9 $2,248.6

Accounts 31+ days past due................................................................. $ 37.4 $ 31.1 $ 31.4

Past due accounts as a percentage of ending managed receivables ....... 1.35% 1.24% 1.40%

CREDIT LOSS INFORMATION

Years Ended February 28 or 29

(In millions) 2006 2005 2004

Net credit losses on managed receivables............................................ $ 18.4 $ 19.5 $ 21.1

Average managed receivables............................................................... $2,657.7 $2,383.6 $2,099.4

Net credit losses as a percentage of average managed receivables ....... 0.69% 0.82% 1.01%

Recovery rate ........................................................................................ 51% 46% 42%

We are at risk for the performance of the managed securitized receivables to the extent of our retained

interest in the receivables. If the managed receivables do not perform in accordance with the assumptions used

in determining the fair value of the retained interest, our earnings could be impacted. We believe the decreases

in net credit losses as a percentage of average managed receivables in fiscal 2006 and fiscal 2005 were due to a

combination of factors, including improved general economic conditions, the implementation of a new credit

scorecard in fiscal 2003, operational efficiencies resulting from system enhancements, and improved recovery

rates. This improved net credit loss performance was reflected in the favorable adjustments to our loss rate

assumptions recorded in fiscal 2006 and fiscal 2005. The recovery rate represents the average percentage of the

outstanding principal balance CarMax receives when a vehicle is repossessed or surrendered by the customer

and sold at wholesale auction. We believe the improvements in the recovery rate reflect the effects of the

strengthening wholesale market pricing environment through fiscal 2005 and fiscal 2006.

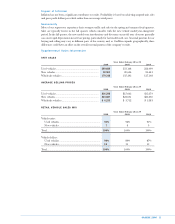

Selling, General, and Administrative Expenses

Fiscal 2006 Versus Fiscal 2005. The SG&A ratio was 10.4% in both fiscal 2006 and fiscal 2005. The

moderate rate of increase in comparable store used unit sales in fiscal 2006 was not sufficient to provide SG&A

leverage. The increase in the percentage of our store base that is comprised of newer stores not yet at basic

maturity, which generally occurs in the fifth year of operation, also was a contributing factor. Newer stores

typically experience higher SG&A ratios during their first four years of operation. On average, 45% of our

stores were less than four years old in fiscal 2006 compared with 37% in fiscal 2005. Costs associated with the

launch of market-wide television advertising in Los Angeles in fiscal 2006 and the lower-than-normal corporate

bonus expense in fiscal 2005 also precluded SG&A leverage.

Fiscal 2005 Versus Fiscal 2004. The SG&A ratio increased to 10.4% in fiscal 2005 from 10.2% in fiscal

2004. The fiscal 2005 SG&A ratio was adversely affected by the deleveraging impact of lower comparable store

unit sales experienced in the first half of the fiscal year, the increase in the percentage of our store base

comprised of stores not yet at basic maturity, and modestly higher operating expenses associated with being a

standalone company following the fiscal 2003 separation from Circuit City Stores, Inc. On average, 37% of our

stores were less than four years old in fiscal 2005 compared with 30% in fiscal 2004. We estimate standalone

costs were approximately $3 million to $4 million higher in fiscal 2005 than in fiscal 2004 because of the

termination of certain transition services previously provided by Circuit City Stores, Inc.

30

CARMAX 2006