CarMax 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

CARMAX 2006

Funding Policy. For the defined benefit pension plan, the company contributes amounts sufficient to meet

minimum funding requirements as set forth in the employee benefit and tax laws plus any additional amounts

as the company may determine to be appropriate. The company expects to contribute at least $11.0 million to

the pension plan in fiscal 2007.

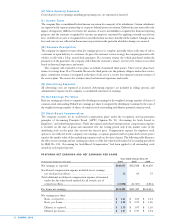

Funded Status. The funded status represents the difference between the projected benefit obligations and

the market value of the assets.

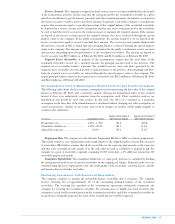

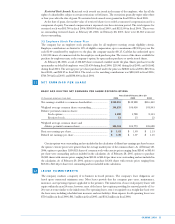

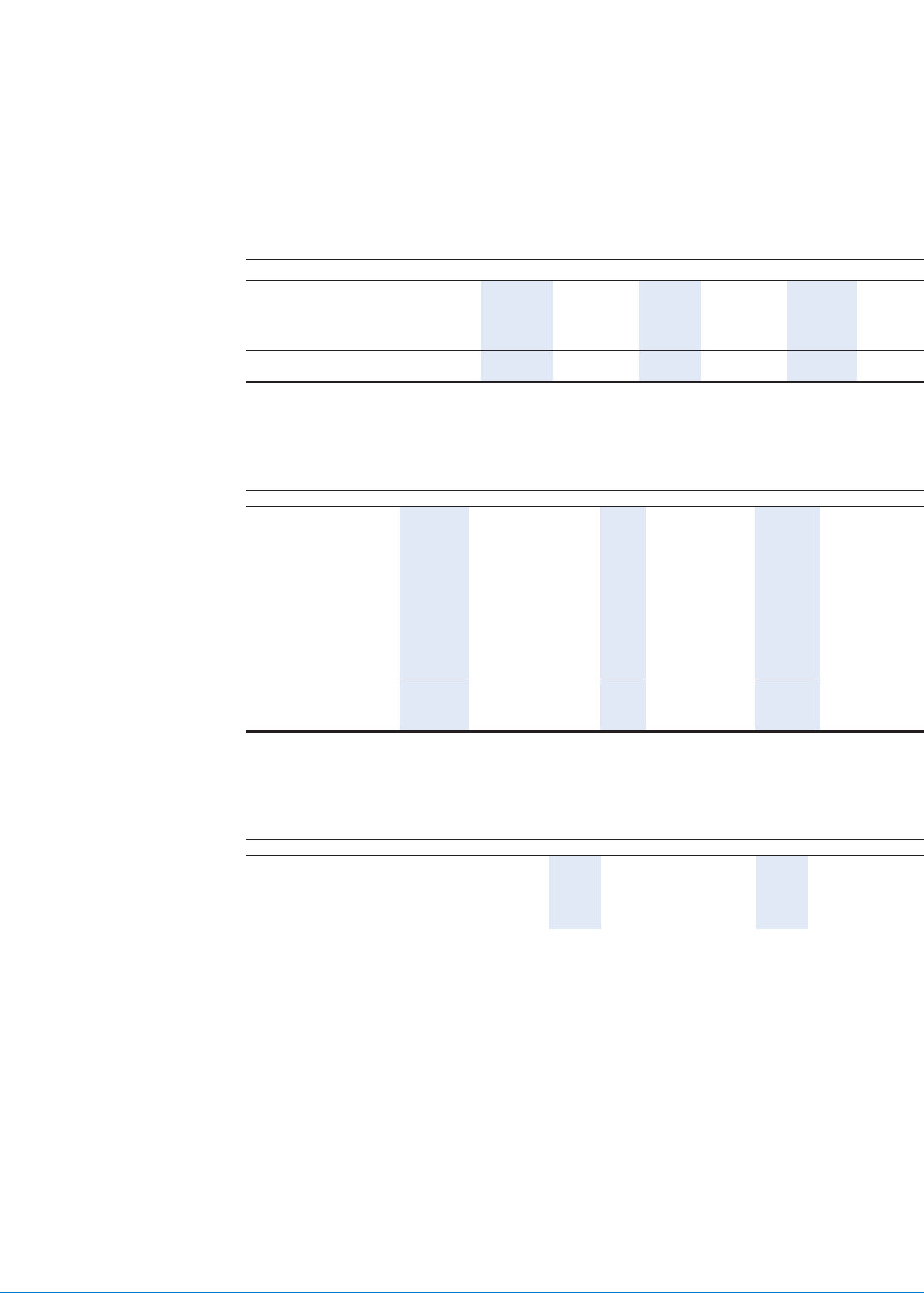

FUNDED STATUS RECONCILIATION

As of February 28

Pension Plan Restoration Plan Total

(In thousands) 2006 2005 2006 2005 2006 2005

Funded status................................... $(39,392) $(23,358) $(6,864) $(4,508) $(46,256) $ (27,866)

Unrecognized actuarial loss ............ 23,947 13,877 3,427 1,945 27,374 15,822

Unrecognized prior service cost ..... 220 257 217 242 437 499

Net amount recognized ................... $(15,225) $ (9,224) $(3,220) $(2,321) $(18,445) $(11,545)

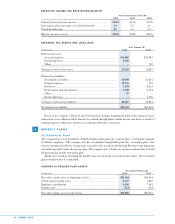

COMPONENTS OF NET PENSION EXPENSE

Years Ended February 28 or 29

Pension Plan Restoration Plan Total

(In thousands) 2006 2005 2004 2006 2005 2004 2006 2005 2004

Service cost................. $ 8,780 $6,557 $5,529 $480 $343 $231 $ 9,260 $6,900 $5,760

Interest cost................. 2,794 2,152 1,679 259 232 126 3,053 2,384 1,805

Expected return

on plan assets........... (2,071) (1,523) (892) ——— (2,071) (1,523) (892)

Amortization of

prior service cost...... 37 37 37 24 24 — 61 61 37

Recognized

actuarial loss ............ 961 736 647 136 149 53 1,097 885 700

Net pension

expense..................... $10,501 $7,959 $7,000 $899 $748 $410 $11,400 $8,707 $7,410

WEIGHTED AVERAGE ASSUMPTIONS USED TO DETERMINE NET PENSION EXPENSE

Years Ended February 28 or 29

Pension Plan Restoration Plan

2006 2005 2004 2006 2005 2004

Discount rate...................................................... 5.75% 6.00% 6.50% 5.75% 6.00% 6.50%

Expected rate of return on plan assets.............. 8.00% 8.00% 9.00% ———

Rate of compensation increase.......................... 5.00% 5.00% 6.00% 7.00% 7.00% 6.00%

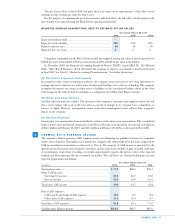

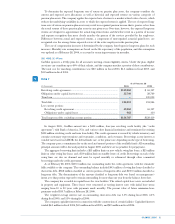

Assumptions Used to Determine Plan Information. Underlying both the calculation of the projected

benefit obligation and the net periodic plan expense are actuarial calculations of each plan’s liability. These

calculations use participant-specific information such as salary, age, and years of service, as well as certain

assumptions, the most significant being the discount rate, expected rate of return on plan assets, rate of

compensation increase, and mortality rate. The company evaluates these assumptions, at a minimum, annually,

and makes changes as necessary.

The discount rate assumption used for the retirement benefit plan accounting reflects the yields available on

high-quality, fixed income debt instruments. For the company’s plans, we review high-quality corporate bond

indices in addition to a hypothetical portfolio of corporate bonds constructed with maturities that approximate

the expected timing of the anticipated benefit payments.