CarMax 2006 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15 CARMAX 2006

CARMAX 2006 15

■For the foreseeable future, we believe we can achieve

average comparable store used unit growth in the range

of 4% to 8% per year. This range assumes modest over-

all market growth, continued CarMax market share

gains, and the effect of higher sales growth rates at stores

that have not yet reached basic maturity.

■We estimate that we have an 8% to 10% market share

of late model, 1- to 6-year-old used cars within the

trade areas of our most mature stores. This benchmark

implies a sales potential of approximately $25 billion

in today’s dollars as our stores reach maturity and we

achieve full national scope.

■Our market share is significantly higher within a 5- to

10-mile radius of our most mature stores. Our satellite

store additions and our small market store test will help

us to determine incremental market share opportunities

and optimal storing densities and patterns.

DEFENSIBLE COMPETITIVE

ADVANTAGE

■There have been several unsuccessful attempts to repli-

cate the CarMax model. Competitors who have tried

to copy our concept have typically failed because they

focused only on our consumer concept. They ignored

the hidden danger of failing to build strong operating

processes early in concept development.

■At present, we are fortunate to have no similar-format,

multi-market challengers. This advantageous competitive

landscape is allowing us to expand on our own timetable,

following our own strategic priorities.

■CarMax has a more than 12-year development advan-

tage over any challenger who attempts to copy our busi-

ness. Building an organization, developing specialized

processes and systems, refining execution…all take time.

■CarMax intends to stay ahead of any potential competi-

tion through relentless attention to people, processes,

and execution.

By focusing on used cars, CarMax can grow organically, unrestrained by franchise law

or manufacturer restrictions. At the end of fiscal 2006, we had 67 used car superstores

in 31 U.S. markets representing approximately one-third of the U.S. population. We

believe the combination of continued geographic expansion and market share gains

resulting from our consumer-preferred concept can fuel growth for years to come.

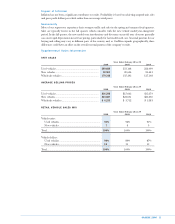

080706050403020100999897969594

58

67

1247

18

29 33 33 35

40

49

In-store inventory kioskTest drive

STORE EXPANSION

(Number of used car superstores at fiscal year end)