CarMax 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

CARMAX 2006

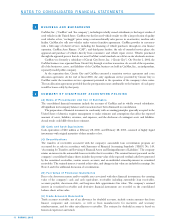

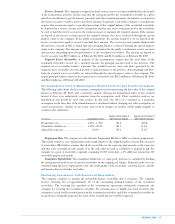

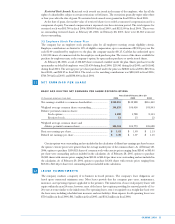

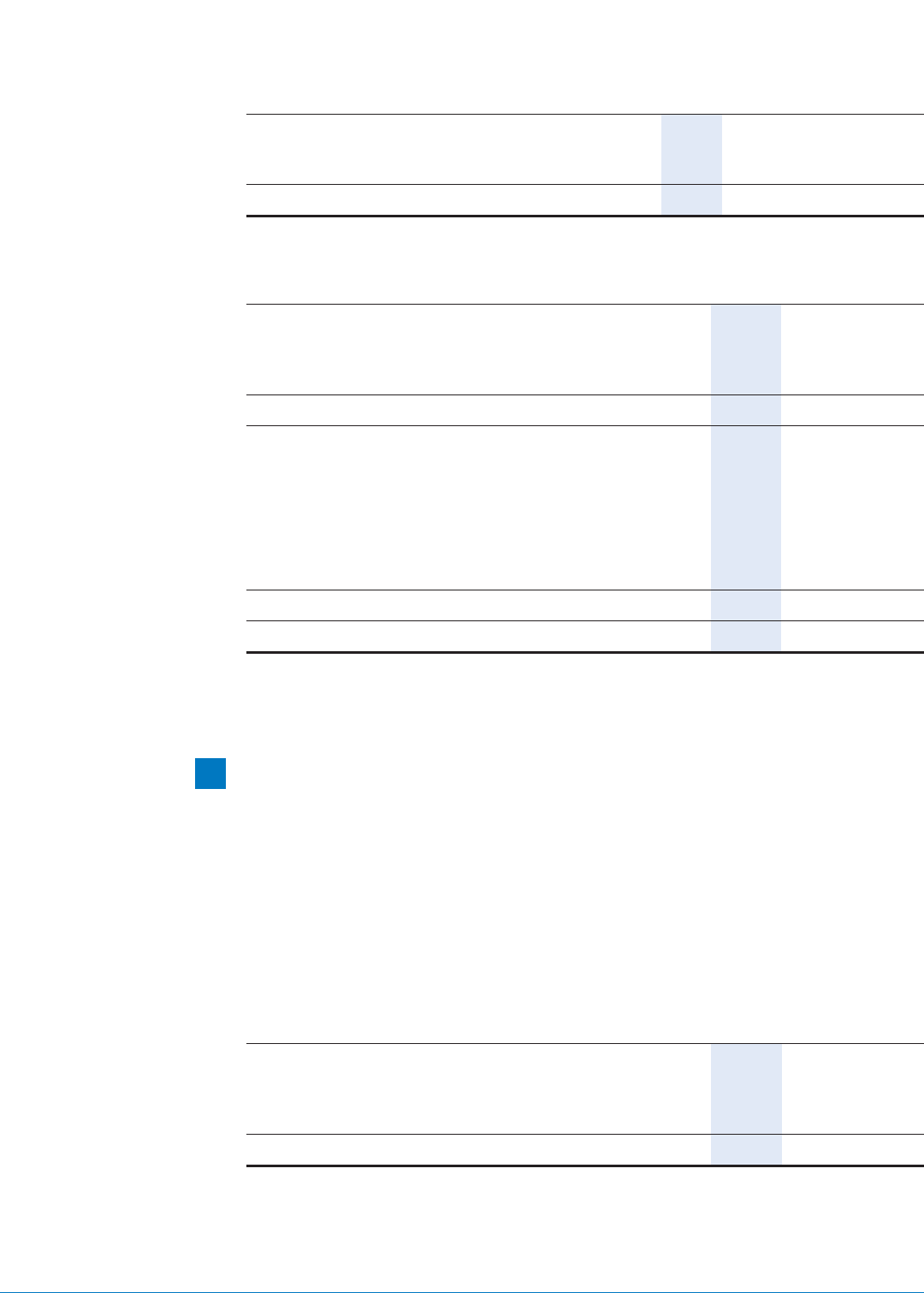

EFFECTIVE INCOME TAX RATE RECONCILIATION

Years Ended February 28 or 29

2006 2005 2004

Federal statutory income tax rate .................................................. 35.0% 35.0% 35.0%

State and local income taxes, net of federal benefit...................... 3.0%3.5%3.1%

Nondeductible items....................................................................... 0.3%0.3%0.4%

Effective income tax rate................................................................ 38.3% 38.8% 38.5%

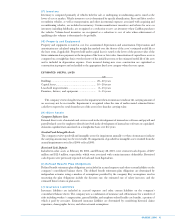

DEFERRED TAX ASSETS AND LIABILITIES

As of February 28

(In thousands) 2006 2005

Deferred tax assets:

Accrued expenses................................................................................... $16,887 $12,381

Partnership basis.................................................................................... 6,229 —

Other ...................................................................................................... —100

Total gross deferred tax assets.................................................................... 23,116 12,481

Deferred tax liabilities:

Securitized receivables ........................................................................... 19,699 23,301

Prepaid expenses.................................................................................... 10,757 157

Inventory................................................................................................ 7,476 8,515

Depreciation and amortization.............................................................. 4,508 7,744

Other ...................................................................................................... 27 —

Partnership basis.................................................................................... —4,106

Total gross deferred tax liabilities............................................................... 42,467 43,823

Net deferred tax liability............................................................................. $19,351 $31,342

Based on the company’s historical and current pretax earnings, management believes the amount of gross

deferred tax assets will more likely than not be realized through future taxable income and future reversals of

existing temporary differences; therefore, no valuation allowance is necessary.

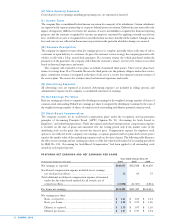

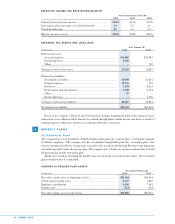

BENEFIT PLANS

(A) Retirement Plans

The company has a noncontributory defined benefit pension plan (the “pension plan”) covering the majority

of full-time employees. The company also has an unfunded nonqualified plan (the “restoration plan”) that

restores retirement benefits for certain senior executives who are affected by Internal Revenue Code limitations

on benefits provided under the pension plan. The company uses a fiscal year end measurement date for both

the pension plan and the restoration plan.

Assets. Assets used in calculating the funded status are measured at current market values. The restoration

plan is excluded since it is unfunded.

CHANGES IN PENSION PLAN ASSETS

Years Ended February 28

(In thousands) 2006 2005

Fair value of plan assets at beginning of year ........................................... $25,316 $16,404

Actual return on plan assets ....................................................................... 2,357 1,849

Employer contributions .............................................................................. 4,500 7,381

Benefits paid ................................................................................................ (213) (318)

Fair value of plan assets at end of year...................................................... $31,960 $25,316

8