CarMax 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

CARMAX 2006

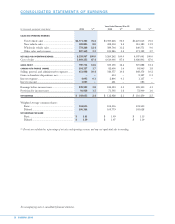

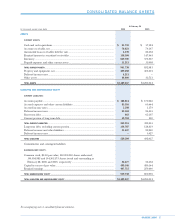

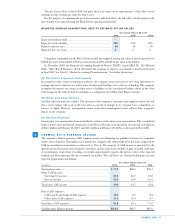

CONSOLIDATED STATEMENTS OF CASH FLOWS

See accompanying notes to consolidated financial statements.

Years Ended February 28 or 29

(In thousands)

2006 2005 2004

OPERATING ACTIVITIES:

Net earnings................................................................................................... $148,055 $112,928 $116,450

Adjustments to reconcile net earnings to net

cash provided by operating activities:

Depreciation and amortization ................................................................ 26,692 20,145 16,181

Amortization of restricted stock awards.................................................. 54 108 122

Gain on disposition of assets ................................................................... (764) (1,486) (1,462)

Provision for deferred income taxes........................................................ (11,991) (1,184) (1,298)

Changes in operating assets and liabilities:

Increase in accounts receivable, net ................................................... (454) (3,809) (15,909)

Decrease (increase) in automobile loan receivables

held for sale, net ............................................................................ 18,013 (3,371) (15,202)

Increase in retained interest in securitized receivables...................... (10,345) (1,975) (10,972)

(Increase) decrease in inventory......................................................... (93,133) (110,506) 389

Decrease (increase) in prepaid expenses and other current assets ... 1,797 (4,358) 3,986

(Increase) decrease in other assets...................................................... (5,975) 1,042 3,147

Increase in accounts payable, accrued expenses and other

current liabilities, and accrued income taxes................................ 47,461 35,876 48,570

Increase in deferred revenue and other liabilities.............................. 2,885 2,326 2,962

NET CASH PROVIDED BY OPERATING ACTIVITIES

.......................................................... 122,295 45,736 146,964

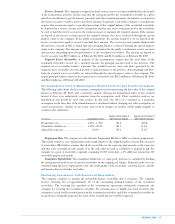

INVESTING ACTIVITIES:

Capital expenditures...................................................................................... (194,433) (230,080) (181,338)

Proceeds from sales of assets......................................................................... 78,340 88,999 107,493

NET CASH USED IN INVESTING ACTIVITIES

.................................................................. (116,093) (141,081) (73,845)

FINANCING ACTIVITIES:

(Decrease) increase in short-term debt, net .................................................. (64,734) 60,751 (51,605)

Issuance of long-term debt ............................................................................ 174,929 ——

Payments on long-term debt ......................................................................... (116,993) (509) —

Issuances of equity through stock incentive plans ....................................... 6,035 4,306 4,613

Purchases of shares for employee stock purchase plan ............................... (804) (747) (599)

NET CASH (USED IN) PROVIDED BY FINANCING ACTIVITIES

............................................ (1,567) 63,801 (47,591)

Increase (decrease) in cash and cash equivalents .............................................. 4,635 (31,544) 25,528

Cash and cash equivalents at beginning of year............................................... 17,124 48,668 23,140

CASH AND CASH EQUIVALENTS AT END OF YEAR

............................................................... $ 21,759 $ 17,124 $ 48,668

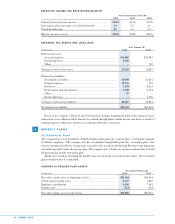

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

Cash paid during the year for:

Interest ...................................................................................................... $ 7,928 $ 5,726 $ 4,695

Income taxes............................................................................................. $ 94,112 $ 72,022 $ 59,987

Noncash investing and financing activities:

Asset acquisitions from capitalization of leases....................................... $ 7,864 $ 29,258 $ —

Long-term debt obligations from capitalization of leases ....................... $ 7,864 $ 29,258 $ —