CarMax 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

CARMAX 2006

Fiscal 2007 Expectations

The fiscal 2007 expectations discussed below are based on historical and current trends in our business and

should be read in conjunction with the “Cautionary Information About Forward-Looking Statements” section

of this MD&A.

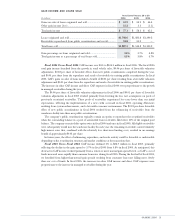

Fiscal 2007 Sales. We currently anticipate comparable store used unit growth for fiscal 2007 in the range of

2% to 8%. The width of the range reflects the uncertainty of the current market environment. The growth in

total sales and revenues is expected to be significantly lower than the 19% increase achieved in fiscal 2006. This

decrease reflects the difference in store opening patterns. In fiscal 2006, our openings were skewed to the first

half of the year, while in fiscal 2007, store opening dates will be heavily weighted to the second half of the year.

In addition, we do not expect our wholesale sales to repeat the exceptional performance achieved in fiscal 2006.

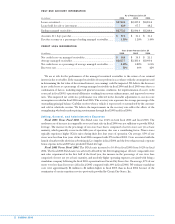

Accounting for Stock-Based Compensation. Effective March 1, 2006, we adopted SFAS No. 123 (Revised

2004), “Share-Based Payment,” which modifies SFAS No. 123, “Accounting for Stock-Based Compensation.”

SFAS No. 123(R) requires that all stock-based compensation, including employee stock options, be

accounted for using a fair-value-based method. The effect of the adoption of this accounting change on our

fiscal 2007 diluted earnings per share is expected to be a reduction of approximately $0.18 to $0.20. As

required by SFAS No. 123(R), this estimate includes expensing all outstanding unvested options held by our

retiring chief executive officer, as well as accelerated recognition of stock-based compensation expense of

new options for associates who will reach retirement eligibility earlier than the end of the stated vesting

period. The estimate does not include any expense that may result from an additional equity grant, if any,

issued to a new chief executive officer. SFAS No. 123(R) will be adopted on a modified retrospective basis

and results for prior periods will be restated, enhancing comparability. Prior period restatements will reflect

compensation costs in the amounts previously reported in the pro forma footnote disclosures under the

provisions of SFAS No. 123. The effect of the restatement on fiscal 2006 results is estimated to be a $0.12

reduction from $1.39 to $1.27 in diluted earnings per share.

Fiscal 2007 Earnings Per Share. Excluding the estimated effect of expensing stock-based compensation,

we expect fiscal 2007 earnings per share in the range of $1.45 to $1.65, representing EPS growth in the range of

4% to 19%. Including the estimated expense for stock-based compensation, but excluding any expense from an

additional equity grant, if any, for a new chief executive officer, we expect fiscal 2007 earnings per share in the

range of $1.25 to $1.47, reflecting EPS performance in the range of (2)% to 16%. This expectation recognizes

estimated stock-based compensation expense of $0.12 for fiscal 2006 and approximately $0.18 to $0.20 for

fiscal 2007. Excluding the $0.09 of favorable CAF items in fiscal 2006 and including the estimated expense for

stock-based compensation, earnings per share growth would be in the range of 6% to 25%.

We expect modest improvement in used vehicle gross profit dollars per unit as wholesale pricing moderates.

During the first half of fiscal 2007, we expect wholesale gross profit dollars per unit to increase and wholesale

sales to grow at approximately the same rate as our retail sales. During the third quarter, we expect wholesale

sales to continue to grow, but gross margins to moderate in comparison to the unusual circumstances in the

third quarter of fiscal 2006. In the fourth quarter, we expect both wholesale sales growth and margins to

moderate. Overall, we expect wholesale sales and gross profit to increase in line with used retail sales growth.

We expect a slight decline in CAF income due to the $0.09 per share of favorable CAF items reported in

fiscal 2006. CAF gain spreads are expected to be at the low end of our normalized 3.5% to 4.5% range in the

first half of fiscal 2007. The gain spread could improve modestly in the second half of the year, depending on

interest rate trends and other economic factors.

If we perform at or above the mid-point of our range of expected comparable store used unit sales, we

expect a modest amount of SG&A leverage in fiscal 2007, including an expected increase in costs of

approximately $5 million associated with moving our data center, and excluding expenses related to stock-

based compensation. We expect our effective tax rate for fiscal 2007 will be similar to the fiscal 2006 rate.

RECENT ACCOUNTING PRONOUNCEMENTS

For a discussion of recent accounting pronouncements applicable to the company, see Note 15 to the

company’s consolidated financial statements.