CarMax 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2006

49

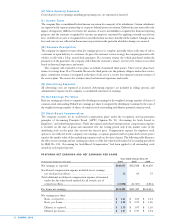

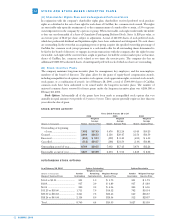

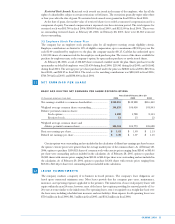

PENSION PLAN ASSET ALLOCATION

As of February 28

2006 2005

Target Actual Target Actual

Allocation Allocation Allocation Allocation

Equity securities .............................................................. 75% 78% 80% 76%

Fixed income securities ................................................... 25 22 20 24

Total ................................................................................. 100% 100% 100% 100%

The company’s pension plan assets are held in trust. The company sets investment policies and strategies for

the pension plan. Long-term strategic investment objectives include preserving the assets of the trust and

balancing risk and return. The company oversees the investment allocation process, which includes selecting

investment managers, setting long-term strategic targets, and monitoring asset allocations. Target allocations are

guidelines, not limitations, and occasionally plan fiduciaries will approve allocations above or below the targets.

Benefit Obligations. The projected benefit obligations are the present value of future benefits to employees,

including assumed salary increases. The accumulated benefit obligations are based on employee service as of

the date reported, excluding assumed future service and salary increases.

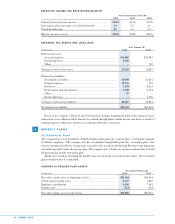

BENEFIT OBLIGATIONS AND PLAN ASSETS

As of February 28

Pension Plan Restoration Plan Total

(In thousands) 2006 2005 2006 2005 2006 2005

Projected benefit obligation ........ $71,352 $48,674 $6,864 $4,508 $78,216 $53,182

Accumulated benefit obligation .. $45,151 $30,646 $3,805 $2,419 $48,956 $33,065

Fair value of plan assets .............. $31,960 $25,316 ——$31,960 $25,316

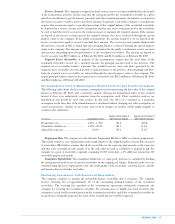

CHANGES IN THE PROJECTED BENEFIT OBLIGATIONS

Years Ended February 28

Pension Plan Restoration Plan Total

(In thousands) 2006 2005 2006 2005 2006 2005

Projected benefit obligation at

beginning of year ................... $48,674 $35,918 $4,508 $3,596 $53,182 $39,514

Service cost .................................. 8,780 6,557 480 343 9,260 6,900

Interest cost.................................. 2,794 2,152 259 232 3,053 2,384

Plan amendments ........................ — — —267 —267

Actuarial loss ............................... 11,317 4,365 1,617 70 12,934 4,435

Benefits paid ................................ (213) (318) ——(213) (318)

Projected benefit obligation

at end of year ......................... $71,352 $48,674 $6,864 $4,508 $78,216 $53,182

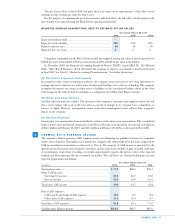

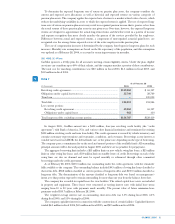

WEIGHTED AVERAGE ASSUMPTIONS USED TO DETERMINE THE BENEFIT OBLIGATIONS

As of February 28

Pension Plan Restoration Plan

2006 2005 2006 2005

Discount rate.................................................................. 5.75% 5.75% 5.75% 5.75%

Rate of compensation increase...................................... 5.00% 5.00% 7.00% 7.00%

ESTIMATED FUTURE BENEFIT PAYMENTS

Pension Restoration

(In thousands) Plan Plan

Fiscal 2007 ..................................................................................................... $ 233 $ 72

Fiscal 2008 ..................................................................................................... $ 327 $ 134

Fiscal 2009 ..................................................................................................... $ 476 $ 228

Fiscal 2010 ..................................................................................................... $ 678 $ 286

Fiscal 2011 ..................................................................................................... $ 954 $ 322

Fiscal 2012 through 2016.............................................................................. $10,999 $1,988