Blackberry 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

68

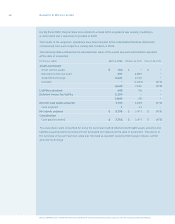

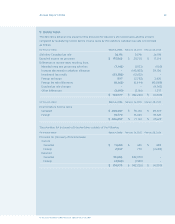

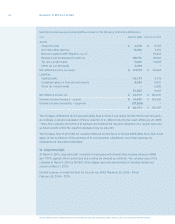

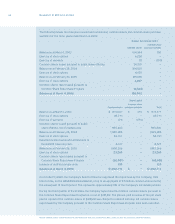

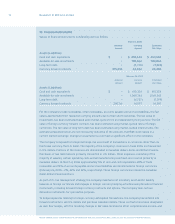

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

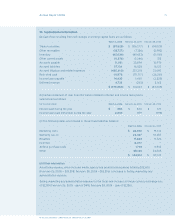

15. Litigation

The Company was the defendant in a patent litigation matter brought by NTP, Inc. (“NTP”) alleging that

the Company infringed on eight of NTP’s patents.

The matter went to trial in 2002 in the United States District Court for the Eastern District of Virginia (“the

District Court”), and the jury issued a verdict in favor of NTP. In 2003, the District Court ruled on NTP’s

request for an injunction with respect to RIM continuing to sell BlackBerry devices, software and service in

the United States. The District Court granted NTP the injunction requested; however, the District Court

then immediately granted RIM’s request to stay the injunction sought by NTP pending the completion of

RIM’s appeal. In December 2004, the Court of Appeals for the Federal Circuit (the “CAFC”) ruled on the

appeal by the Company of the District Court’s judgment. In August 2005, the CAFC granted RIM’s request

to reconsider the December 2004 decision. The CAFC’s August 2005 decision vacated the District Court’s

judgment and the injunction, and remanded the case to the District Court for further proceedings

consistent with the CAFC’s ruling. Further court proceedings followed.

For the year ended February 28, 2004, the Company recorded charges with respect to the NTP matter

totaling $35.2 million to fully provide for enhanced compensatory damages, current and estimated future

costs with respect to ongoing legal and professional fees, prejudgment interest, and postjudgment interest

for the period August 6, 2003 to February 28, 2004. The $36.3 million attributable to enhanced

compensatory damages and postjudgment interest was classied as

Restricted cash

on the Consolidated

Balance Sheets as at February 28, 2004.

On March 16, 2005, the parties jointly announced the signing of a binding Term Sheet to resolve all current

litigation between them. The parties announced that RIM would pay NTP $450 million in nal and full

resolution of all claims to date against RIM, as well as a fully-paid up license going forward. During scal

2005, the Company recorded an incremental expense of $352.6 million to adjust the total NTP provision

to the resolution amount plus current and estimated legal, professional and other fees, less the previous

cumulative quarterly provisions for enhanced compensatory damages, prejudgment interest, plaintiff’s

attorney fees, estimated postjudgment interest, and current and estimated future costs with respect to

legal and other professional fees, and the acquisition of a $20 million intangible asset. The $76.2 million

attributable to enhanced compensatory damages and postjudgment interest with respect to scal 2005

was classied as

Restricted cash

on the Consolidated Balance Sheets as at February 26, 2005.

On June 9, 2005, RIM announced that, due to an impasse in the process of nalizing a denitive licensing

and settlement agreement, RIM would take court action to enforce the Term Sheet. Further court

proceedings followed. On November 30, 2005, the District Court ruled that the March 2005 settlement was

not enforceable. During the third quarter of scal 2006, the Company recorded an expense of $26.2 million

to account for incremental current and estimated future legal and professional fees in the amount of

$7.9 million as well as an accrual in the amount of $18.3 million to write-off the intangible asset following

the November 30, 2005 ruling.