Blackberry 2006 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

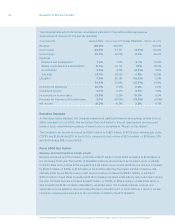

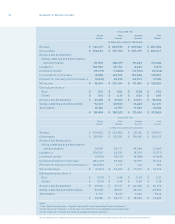

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Annual Report 2006 21

For the years ended March 4, 2006, February 26, 2005 and February 28, 2004

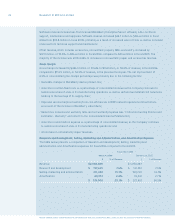

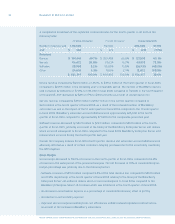

Gross margin increased to $1.14 billion, or 55.2% of revenue in scal 2006, compared to $714.5 million,

or 52.9% of revenue, in scal 2005. The increase of 2.3% in gross margin percentage in scal 2006 is

primarily attributable to increased manufacturing and service delivery cost efciencies as a result of the

increase in device volumes, favorable overall product mix, including higher software and NRE revenues in

scal 2006, lower net warranty expense as well as the Company’s continuing cost reduction efforts for its

BlackBerry devices and service revenue streams which was partially offset by a 6.8% decrease in ASP.

The Company continued to invest in research and development, and sales, marketing and administration

in scal 2006. These expenses increased by $191.1 million, or 58.3%, to $519.0 million in scal 2006 from

$327.9 million in the preceding scal year. The 58.3% increase in scal 2006 was higher than the revenue

increase of 53.0% reecting the Company’s investment in research and development and sales and

marketing activities.

Litigation expenses totalled $201.8 million, a decrease of $150.8 million from $352.6 million in scal 2005,

as a result of the Company and NTP completing a full and nal settlement agreement for $612.5 million

on March 3, 2006. The litigation expense of $201.8 million reects the incremental amount required to

adjust the accrual from $450 million to the $612.5 million amount, the write-off of the intangible asset

plus additional legal and other professional fees incurred during scal 2006 – see “Results of Operations –

Litigation” and note 15 to the Consolidated Financial Statements.

Investment income increased by $29.1 million to $66.2 million in scal 2006 from $37.1 million in scal

2005 primarily as a result of improved investment yields and the increase in cash, cash equivalents,

short-term investments and investments.

The Company recorded income tax expense of $104.0 million in scal 2006 compared to an income tax

recovery of $142.2 million in scal 2005 — see “Results of Operations — Income Taxes” and note 9 to the

Consolidated Financial Statements.

Net income increased by $168.7 million to $382.1 million, or $2.02 basic EPS and $1.96 diluted EPS, in scal

2006 compared to net income of $213.4 million, or $1.14 basic EPS and $1.09 diluted EPS in the prior year.

See “Results of Operations – Net Income” for an analysis and reconciliation of the scal 2006 increase in

net income and EPS.

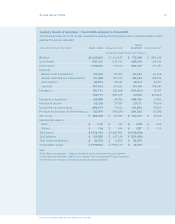

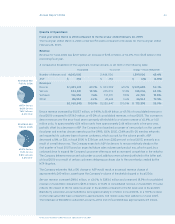

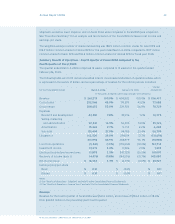

Selected Quarterly Financial Data

The following table sets forth RIM’s unaudited quarterly consolidated results of operations data for each

of the eight most recent quarters ended March 4, 2006. The information has been derived from RIM’s

quarterly unaudited consolidated nancial statements that, in management’s opinion, have been prepared

on a basis consistent with the Consolidated Financial Statements and include all adjustments necessary

for a fair presentation of information when read in conjunction with the Consolidated Financial Statements.

RIM’s quarterly operating results have varied substantially in the past and may vary substantially in the

future. Accordingly, the information below is not necessarily indicative of results for any future quarter.