Blackberry 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

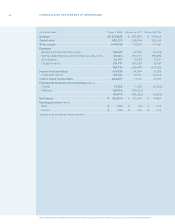

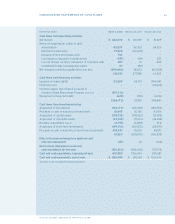

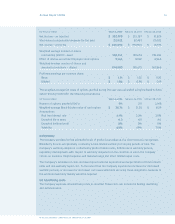

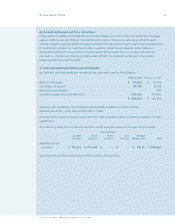

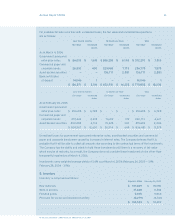

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Annual Report 2006 45

For the years ended March 4, 2006, February 26, 2005 and February 28, 2004

effect at the consolidated balance sheet date, non-monetary assets and liabilities at historical exchange

rates, and revenues and expenses at the rates of exchange prevailing when the transactions occurred.

Resulting exchange gains and losses are included in income.

(f) Cash and cash equivalents

Cash and cash equivalents consist of balances with banks and highly liquid investments with maturities

of three months or less at the date of acquisition and are carried on the consolidated balance sheets at

cost plus accrued interest, which approximates their fair value.

(g) Trade receivables

Trade receivables which reect invoiced and accrued revenue are presented net of an allowance for

doubtful accounts. The allowance was $1,551 at March 4, 2006 (February 26, 2005 — $1,697). Bad debt

expense (recovery) was ($552) for the year ended March 4, 2006 (February 26, 2005 — ($500);

February 28, 2004 — ($548)).

The allowance for doubtful accounts reects estimates of probable losses in trade receivables. The Company

is dependent on a number of signicant customers and on large complex contracts with respect to sales

of the majority of its products, software and services. The Company expects the majority of trade

receivables to continue to come from large customers as it sells the majority of its devices and software

products and service relay access through network carriers and resellers rather than directly. The

Company evaluates the collectibility of its trade receivables based upon a combination of factors on a

periodic basis.

When the Company becomes aware of a specic customer’s inability to meet its nancial obligations to the

Company (such as in the case of bankruptcy lings or material deterioration in the customer’s operating

results or nancial position, and payment experiences), RIM records a specic bad debt provision to reduce

the customer’s related trade receivable to its estimated net realizable value. If circumstances related to

specic customers change, the Company’s estimates of the recoverability of trade receivables balances

could be further adjusted.

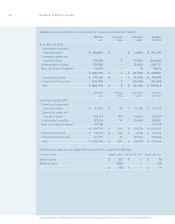

(h) Investments

The Company’s investments consist of money market and other debt securities, and are classied as

available-for-sale for accounting purposes. The Company does not exercise signicant inuence with

respect to any of these investments.

Investments with maturities of less than one year, as well as any investments that management intends

to hold for less than one year, are classied as Short-term investments. Investments with maturities of

one year or more are classied as Investments.

In scal 2005, the Company reviewed its intent to continue to hold investments previously classied as

held-to-maturity and determined this intent was no longer present. These investments were reclassied

as available-for-sale, and prior period carrying values were adjusted to reect these securities as available-

for-sale since acquisition. This change results in an increase of $5,399 in the carrying amount of investments

at February 28, 2004, and an increase in accumulated other comprehensive income of $5,399 for the year

ended February 28, 2004 (March 1, 2003 – increase of $4,158).

Investments classied as available-for-sale under Statement of Financial Accounting Standards (“SFAS”)

115 are carried at fair value. Changes in market value are accounted for through accumulated other

comprehensive income until such investments mature or are sold.