Blackberry 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Annual Report 2006 57

For the years ended March 4, 2006, February 26, 2005 and February 28, 2004

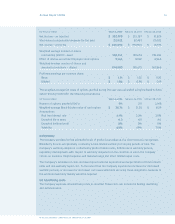

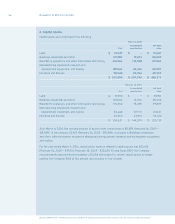

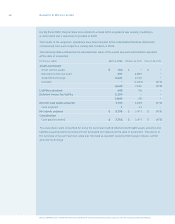

7. Intangible Assets

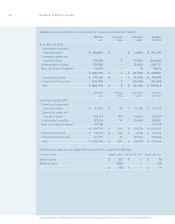

Intangible assets are comprised of the following:

Acquired technology

Licenses

Patents

February 26, 2005

Accumulated Net book

Cost amortization value

Acquired technology $ 12, 1 5 1 $ 6,045 $ 6,1 06

Licenses 86,352 31,1 07 55,245

Patents 28,082 5,693 22,389

$ 126,585 $ 42,845 $ 83,740

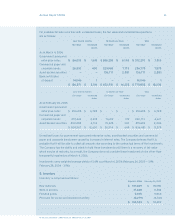

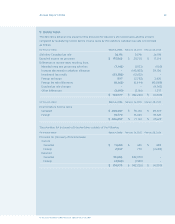

During scal 2004, the Company recorded provisions amounting to $4,327 against the carrying values

of certain of its intangible assets as a result of changes in the Company’s current and intended product

offerings. Of this amount $2,750 was included in

Cost of sales

with the balance of $1,577 recorded

as

Amortization expense

. Such charges reected management’s assessment of net realizable values.

For the year ended March 4, 2006, amortization expense related to intangible assets was $23,195

(February 26, 2005 — $19,730; February 28, 2004 — $19,462). Total additions to intangible assets in 2006

were $45,384 (2005 — $37,061).

Based on the carrying value of the identied intangible assets as at March 4, 2006, and assuming no

subsequent impairment of the underlying assets, the annual amortization expense for the next ve years

is expected to be as follows: 2007 — $23 million; 2008 — $17 million; 2009 — $5 million; 2010 — $5 million;

and 2011 — $3 million.

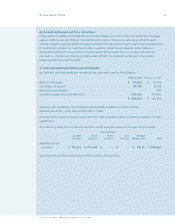

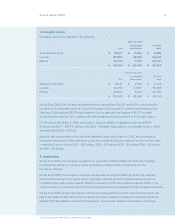

8. Acquisitions

During scal 2006, the Company completed one acquisition. Effective March 24, 2005, the Company

purchased the shares of a company whose proprietary software will be incorporated into the

Company’s software.

During scal 2005, the Company completed two acquisitions. Effective March 19, 2004, the Company

purchased the assets of a company whose proprietary software products enable wireless access to a

corporate email system using a device. Effective February 11, 2005, the Company acquired 100% of the

common shares of a company that offers technology that will be incorporated into the Company’s software.

During scal 2005, and as described in note 9, the Company determined that it was more likely than not

that it can realize its deferred income tax assets. Therefore Company recognized a deferred income tax

benet of $1,083 related to a scal 2003 acquisition. This amount resulted in a reduction of

Goodwill

.