Blackberry 2006 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

16

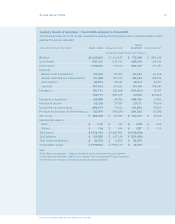

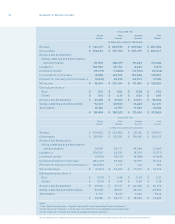

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Warranty

The Company provides for the estimated costs of product warranties at the time revenue is recognized.

BlackBerry devices are generally covered by a time-limited warranty for varying periods of time. The

Company’s warranty obligation is affected by product failure rates, changes in warranty periods, regulatory

developments with respect to warranty obligations in the countries in which the Company carries on

business, freight expense, and material usage and other related repair costs.

The Company’s estimates of costs are based upon historical experience and expectations of future return

rates and unit warranty repair cost. To the extent that the Company experiences changes in warranty

activity, or changes to costs associated with servicing those obligations, revisions to the estimated

warranty liability would be required.

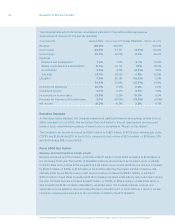

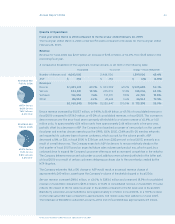

During scal 2006, RIM increased its estimated warranty accrued liability by $4.2 million, or 0.2% of

consolidated revenue, as a result of an increase in both the unit warranty repair costs and in the current

and expected future returns (for warranty repair) rates for certain of its devices.

The Company estimates that a 10% change to either the current average unit warranty repair cost,

measured against the device sales volumes currently under warranty as at March 4, 2006, or to the

current average warranty return rate, would have resulted in adjustments to warranty expense and pre-tax

earnings of approximately $2.2 million.

Investments

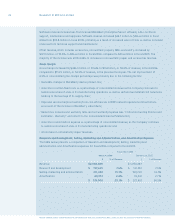

The Company’s investments are classied as available-for-sale under Statement of Financial Accounting

Standards 115 and are carried at fair value. Changes in fair values are accounted for through accumulated

other comprehensive income, until such investments mature or are sold. The Company does not exercise

signicant inuence with respect to any of these investments.

In scal 2005, the Company reviewed its intent to continue to hold certain investments previously

classied as held-to-maturity and determined this intent was no longer present. These investments were

reclassied as available-for-sale, and prior period carrying values have been adjusted to reect these

securities as available-for-sale since acquisition. This change resulted in an increase of $5.4 million in the

carrying amount of investments at February 28, 2004, and increased other total accumulated

comprehensive income by $5.4 million for the year ended February 28, 2004 (March 1, 2003 — increase of

$4.2 million).

The Company assesses declines in the value of individual investments for impairment to determine whether

the decline is other-than-temporary. The Company makes this assessment by considering available

evidence, including changes in general market conditions, specic industry and individual company data,

the length of time and the extent to which the market value has been less than cost, the nancial condition,

the near-term prospects of the individual investment and the Company’s ability and intent to hold the debt

securities to maturity. In the event that a decline in the fair value of an investment occurs and the decline

in value is considered to be other-than-temporary, an appropriate write-down would be recorded.