Blackberry 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

52

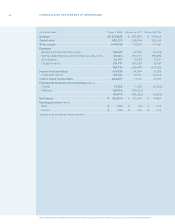

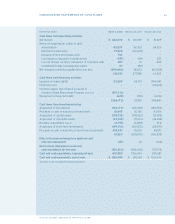

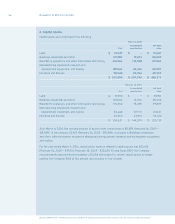

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

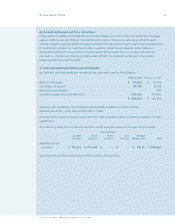

2. Adoption of Accounting Policy

Change in Capital Assets Amortization Method

In scal 2005, the Company reviewed the estimated useful lives of capital assets used in manufacturing,

and research and development operations and the application of the 20% declining balance amortization

method. As a result of plant capacity and capital asset utilizations currently approaching 100%, versus

much lower levels in prior scal years, the Company now believes that the 20% declining balance method

will not produce quarterly and annual amortization expense and resulting residual net book values that are

consistent with the increased current and future capital asset usage. The Company revised its amortization

method to a straight-line method and determined estimated useful lives to be between ve and eight years

for such capital assets, on a prospective basis, effective the second quarter of scal 2005. The impact of

this change in method of accounting was insignicant for scal 2006 and 2005.

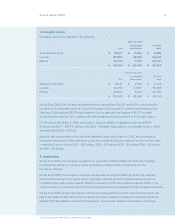

3. Recently Issued Pronouncements

(a) Other-Than-Temporary Impairment of Certain Investments

In March 2004, the Emerging Issues Task Force (“EITF”) released Issue No. 03-01

Other-Than-Temporary

Impairment and its Application to Certain Investments (“EITF 03-01”)

. EITF 03-01 provided guidance when

an investment is considered impaired, whether that impairment is considered to be other-than temporary,

and the measurement of an impairment loss. Rather than provide additional guidance on EITF 03-01, the

FASB issued a proposed FASB Staff Position (“FSP”) EITF 03-1-a

Implementation Guidance for the

Application of Paragraph 16 of EITF Issue 03-01

, which superseded EITF 03-01 and EITF Topic No. D-44,

Recognition of Other-Than-Temporary Impairment upon the Planned Sale of Security Whose Cost Exceeds

Fair Value

. EITF 03-01-a was renamed FSP FAS 115-1

The Meaning of Other-Than-Temporary Impairment

and its Application to Certain Investments

. FSP FAS 115-1 is effective for scal periods beginning after

December 15, 2005. The adoption of FSP FAS 115-1 is not expected to have a signicant impact on the

Company’s results of operations or nancial condition.

(b) Stock-Based Compensation

On December 16, 2004, the FASB issued amended SFAS 123 (“SFAS 123(R)”)

Accounting for Share-Based

Payment

. SFAS 123(R) requires all companies to use the fair-value based method of accounting for stock-

based compensation, and is in effect for all interim periods beginning after June 15, 2005. SFAS 123(R)

requires that all companies adopt either the modied prospective transition (“MPT”) or modied

retrospective transition (“MRT”) method. Stock compensation expense calculated using the MPT approach

would be recognized on a prospective basis in the nancial statements over the requisite service period,

while the MRT method allows a restatement of prior periods for amounts previously recorded as proforma

expense. On April 14, 2005, the U.S. Securities and Exchange Commission announced that it would provide

for a phased-in implementation process for SFAS 123(R). As previously disclosed, the Company will now be

required to adopt a fair-value based method in the rst quarter of scal 2007.