Blackberry 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

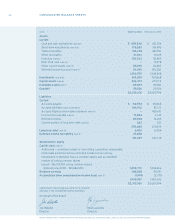

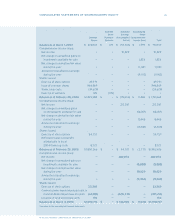

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Annual Report 2006 31

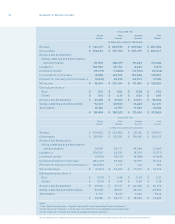

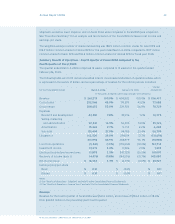

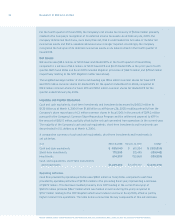

For the years ended March 4, 2006, February 26, 2005 and February 28, 2004

Research and Development, Selling, Marketing and Administration, and Amortization Expense

The table below presents a comparison of Research and development, Selling, marketing and

administration, and Amortization expenses for the fourth quarter ended March 4, 2006 compared to

the quarter ended November 26, 2005 and the fourth quarter ended February 26, 2005. The Company

believes it is also meaningful to provide a comparison between the fourth quarter and the third quarter

of scal 2006, given the quarterly increases in revenue realized by the Company during scal 2006.

Three Month Fiscal Periods Ended

November 26, 2005 February 26, 2005

$ % of Revenue $ % of Revenue

Revenue $ 560,596 $ 404,802

Research and

development $ 41,567 7.4% $ 29,076 7.2%

Selling, marketing

and administration 83,965 15.0% 56,595 14.0%

Amortization 12,797 2.3% 9, 1 14 2.2%

$ 138,329 24.7% $ 94,785 23.4%

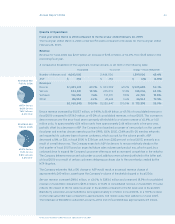

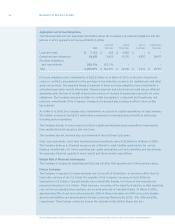

NTP Litigation Matter

As at November 26, 2005, the Company had an accrued liability of $450.0 million in respect of the NTP

litigation which represented, at that time, management’s best current estimate as to the litigation expense

relating to this matter based on then current knowledge and consultation with legal counsel. As the full

and nal settlement amount paid on March 3, 2006 was $612.5 million, an additional charge to earnings in

the amount of $162.5 million was recorded in operating results in the three-month period ending March 4,

2006. During scal 2006, the Patent Ofce issued various ofce actions rejecting all claims in all NTP

patents. Accordingly, though the rulings of the Patent Ofce are subject to appeal by NTP, given the

conclusions and the strength of the conclusions reached by the Patent Ofce, no value has been ascribed

to the NTP license. See “Critical Accounting Policies and Estimates – Litigation”, “Results of Operations –

Litigation” and note 15 to the Consolidated Financial Statements.

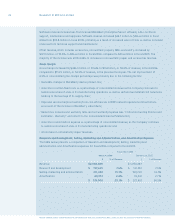

Income Taxes

During the fourth quarter of scal 2006, the Company recorded a net income tax recovery of $4.5 million,

compared to a net tax recovery of $144.6 million in the fourth quarter of scal 2005. The scal 2006

income tax recovery on the incremental NTP settlement amount was in excess of the income tax expense

on pre-tax earnings excluding the litigation accrual.

Prior to the fourth quarter of scal 2006, the deferred income tax asset recorded on the balance sheet

primarily related to the NTP matter and the November 30, 2005 District Court ruling that the Term Sheet

was not binding. Pursuant to the NTP settlement on March 3, 2006, the litigation amount became fully

deductible for income tax purposes in the current quarter. This resulted in a reallocation of income tax

expense between deferred income taxes and current income taxes as well as between different

components of the Company’s deferred income tax asset.