Blackberry 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

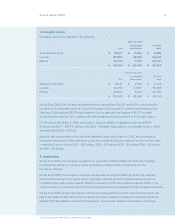

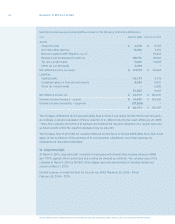

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Annual Report 2006 55

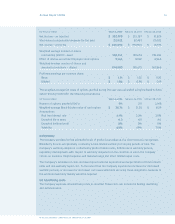

For the years ended March 4, 2006, February 26, 2005 and February 28, 2004

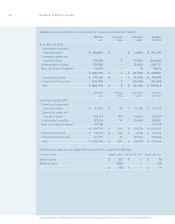

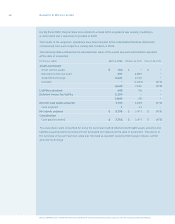

For available-for-sale securities with unrealized losses, the fair value and unrealized loss positions

are as follows:

As at March 4, 2006

Government sponsored

enterprise notes

Commercial paper and

corporate bonds

Asset-backed securities

Bank certicates

of deposit

Less than 12 months 12 months or more Total

Fair Value Unrealized Fair Value Unrealized Fair Value Unrealized

losses losses losses

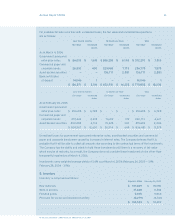

As at February 26, 2005

Government sponsored

enterprise notes $ 351,685 $ 6,198 $ — $ — $ 351,685 $ 6, 1 98

Commercial paper and

corporate bonds 257,424 4,318 11,689 319 269, 1 1 3 4,637

Asset-backed securities 200,458 2,1 14 15,225 330 215,683 2,444

$ 809,567 $ 12,630 $ 26,9 14 $ 649 $ 836,481 $ 13,279

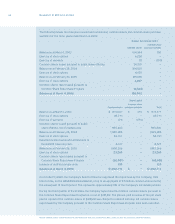

Unrealized losses for government-sponsored enterprise notes, asset-backed securities and commercial

paper and corporate bonds were caused by increases in interest rates. The Company believes that it is

probable that it will be able to collect all amounts due according to the contractual terms of the investments.

The Company has the ability and intent to hold these investments until there is a recovery of fair value

which may be at maturity. As a result, the Company does not consider these investments to be other-than-

temporarily impaired as at March 4, 2006.

Investments carry weighted average yields of 3.4% as at March 4, 2006 (February 26, 2005 — 3.1%;

February 28, 2004 – 3.1%).

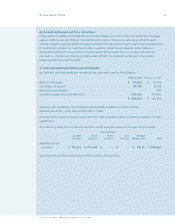

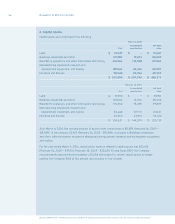

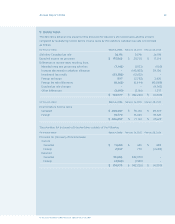

5. Inventory

Inventory is comprised as follows:

February 26, 2005

Raw materials $ 78,080

Work in process 1 1,282

Finished goods 9,868

Provision for excess and obsolete inventory (6,74 1 )

$ 92,489