Blackberry 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

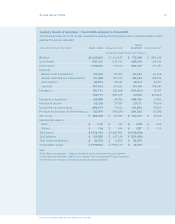

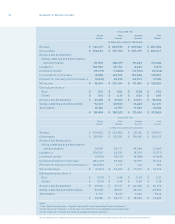

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Annual Report 2006 25

For the years ended March 4, 2006, February 26, 2005 and February 28, 2004

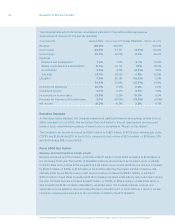

Research and Development

Research and development expenditures consist primarily of salaries for technical personnel, engineering

materials, certication and tooling expense, outsourcing and consulting services, software tools and

related information technology infrastructure support and travel.

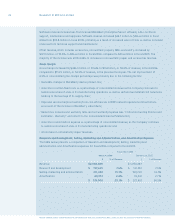

Research and development expenditures increased by $56.4 million to $157.6 million, or 7.6% of revenue,

in scal 2006 compared to $101.2 million, or 7.5% of revenue, in the previous year. The majority of the

increases during the current scal year, compared to scal 2005, were attributable to salaries and benets

(primarily as a result of increased personnel to accommodate the Company’s growth), third party new

product development costs, travel, recruiting, and materials, certication and tooling expenses.

Selling, Marketing and Administration

Selling, marketing and administrative expenses consist primarily of salaries and benets, marketing,

advertising and promotion, travel and entertainment, legal, audit and other professional fees, related

information technology and ofce infrastructure support, recruiting and foreign exchange gain or loss.

Selling, marketing and administrative expenses increased by $120.7 million to $311.4 million for scal

2006 compared to $190.7 million for scal 2005. As a percentage of revenue, selling, marketing and

administrative expenses increased to 15.1% in the current year compared to 14.1% in scal 2005. Sales

and marketing costs continue to increase as the number of carrier partners grow and as efforts into

the prosumer market and retail channels continue to build.

The net increase of $120.7 million in Selling, marketing and administrative expenses was primarily

attributable to increased expenditures for marketing, advertising and promotion expenses, compensation

expense as well as increases in consulting and external advisory costs. Other increases were attributable

to recruiting, travel and legal fees.

Amortization

Amortization expense relating to certain capital and all intangible assets other than licenses increased by

$14.1 million to $50.0 million for scal 2006 compared to $35.9 million for scal 2005. The increased

amortization expense in scal 2006 reects the impact of a full year’s amortization expense with respect

to capital and certain intangible asset expenditures incurred during scal 2005 and also incremental

amortization with respect to capital and certain intangible asset expenditures incurred during scal 2006.

Amortization expense with respect to capital assets employed in the Company’s manufacturing operations

and BlackBerry service operations increased to $18.5 million in scal 2006 compared to $14.3 million in

scal 2005 and is charged to

Cost of sales

in the Consolidated Statements of Operations. The increased

amortization expense in scal 2006 reects the impact of a full year’s amortization expense with respect

to these capital asset expenditures incurred during scal 2005 and also incremental amortization with

respect to capital asset expenditures incurred during scal 2006. See also note 6 to the Consolidated

Financial Statements.