Blackberry 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

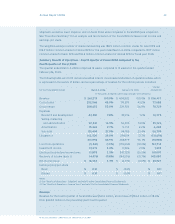

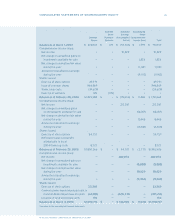

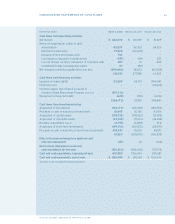

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Annual Report 2006 33

For the years ended March 4, 2006, February 26, 2005 and February 28, 2004

Fiscal Year Ended February 26, 2005

Net income $ 213,387

Amortization 66,760

Deferred income taxes (143,651)

Changes in:

Trade receivables (126,1 77)

Other receivables (7,326)

Inventory (49,653)

Accounts payable 32,894

Accrued liabilities 16,528

Litigation provision 351,218

Restricted cash (75,717)

All other (281)

$ 277,982

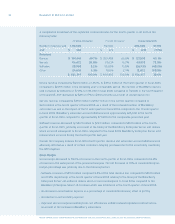

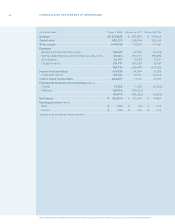

Cash ow used in nancing activities was $368.2 million for scal 2006 compared to cash ow provided by

nancing activities of $54.0 million in scal 2005. The use of cash in scal 2006 was primarily attributable

to the repurchase of 6.3 million common shares in the amount of $391.2 million pursuant to the Company’s

Common Share Repurchase Program.

Cash ow provided by investing activities was $67.3 million for scal 2006, which included capital

asset additions of $178.7 million and intangible asset additions of $23.7 million offset by transactions

involving the proceeds on sale or maturity of short-term investments and investments, net of the costs of

acquisition in the amount of $273.6 million. For the prior scal year, cash ow used in investing activities

was $878.1 million and included capital asset additions of $109.4 million and intangible asset additions

of $17.1 million as well as transactions involving the costs of acquisition of short-term investments and

investments, net of the proceeds on sale or maturity in the amount of $747.8 million.

See also “Litigation” and notes 10 and 15 to the Consolidated Financial Statements.

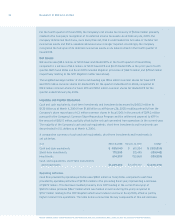

As a result of the denitive licensing and settlement agreements that were signed on March 3, 2006, the

litigation against RIM was dismissed by a court order. The agreement eliminated the need for any further

court proceedings or decisions relating to damages or injunctive relief. On March 3, 2006, RIM paid NTP

$612.5 million in full and nal settlement of all claims against RIM, as well as for a perpetual, fully-paid up

license going forward. This amount included money already escrowed by RIM as of March 3, 2006.

As at March 4, 2006, the Company had a $70 million Letter of Credit Facility (the “Facility”) in place with

a Canadian nancial institution and utilized $48 million of the Facility in order to fund a letter of credit to

partially satisfy the Company’s liability and funding obligation in the NTP matter as described in note 10

to the Consolidated Financial Statements. The Company had pledged specic investments as security for

the Facility. As a result of the settlement of the NTP matter, the Company cancelled the letter of credit on

March 6, 2006, subsequent to the scal 2006 year end.