Blackberry 2006 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

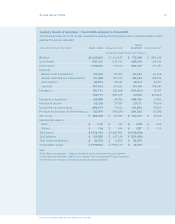

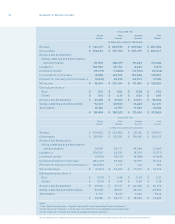

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Annual Report 2006 17

For the years ended March 4, 2006, February 26, 2005 and February 28, 2004

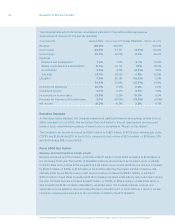

Income taxes

The Company uses the ow-through method to account for investment tax credits (“ITCs”) earned on

eligible scientic research and development (“SR&ED”) expenditures. Under this method, the ITCs are

recognized as a reduction in income tax expense. The liability method of tax allocation is used to account

for income taxes. Under this method, deferred income tax assets and liabilities are determined based upon

differences between the nancial reporting and tax bases of assets and liabilities, and measured using

enacted tax rates and laws that will be in effect when the differences are expected to reverse. The

Company’s deferred income tax asset balance represents temporary differences between the nancial

reporting and tax basis of assets and liabilities, including research and development costs and incentives,

nancing costs, capital assets, non-deductible reserves, and operating loss carryforwards, net of valuation

allowances. The Company considers both positive evidence and negative evidence, to determine whether,

based upon the weight of that evidence, a valuation allowance is required. Judgment is required in

considering the relative impact of negative and positive evidence. The Company records a valuation

allowance when required to reduce deferred income tax assets to the amount that is more likely than not

to be realized.

Should RIM determine that it is more likely than not that it will not be able to realize all or part of its

deferred income tax assets in future scal periods, the valuation allowance would be increased, resulting

in a decrease to net income in the reporting periods for which such determinations are made.

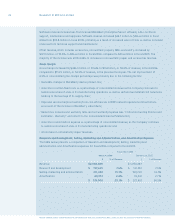

The Company’s provision for income taxes is based on a number of estimates and assumptions as

determined by management and is calculated in each of the jurisdictions in which it conducts business.

The consolidated income tax rate is affected by the amount of net income earned in various operating

jurisdictions and the rate of taxes payable in respect of that income. RIM enters into transactions and

arrangements in the ordinary course of business in which the tax treatment is not entirely certain.

In particular, certain countries in which it operates could seek to tax a greater share of income than has

been provided. The nal outcome of any audits by taxation authorities may differ from estimates and

assumptions used in determining the Company’s consolidated tax provision and accruals, which could

result in a material effect on the consolidated income tax provision and the net income for the period in

which such determinations are made.

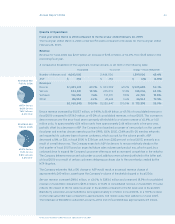

During scal 2006, the tax provision was reduced by $27.0 million as a result of the Company realizing

incremental cumulative investment tax credits attributable to prior scal years. See “Results of Operations

– Income Taxes” and note 9 to the Consolidated Financial Statements.

Stock-Based Compensation

The Company has stock-based compensation plans which are described in note 11(b) to the Consolidated

Financial Statements. Stock options are granted with an exercise price equal to the fair market value of

the shares on the day of grant of the options. Any consideration paid by employees on exercise of stock

options is credited to share capital. Compensation expense is recognized when stock options are issued

with an exercise price of the stock option that is less than the market price of the underlying stock on the

date of grant. The difference between the exercise price of the stock option and the market price of the

underlying stock on the date of grant is recorded as compensation expense (“intrinsic value method”).

As the exercise price of options granted by the Company is equal to the market value of the underlying

stock at the date of grant, no compensation expense has been recognized. This method is consistent with

U.S. GAAP, APB Opinion 25,

Accounting for Stock Issued to Employees

.