Blackberry 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

26

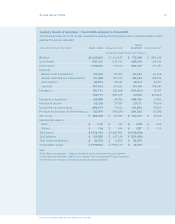

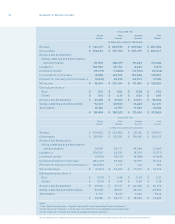

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

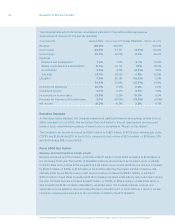

Amortization expense with respect to licenses (a component of Intangible assets) is charged to Cost of

sales and was $17.5 million in scal 2006 compared to $16.5 million in scal 2005.

Total amortization expense with respect to Intangible assets was $23.2 million in scal 2006 compared to

$19.7 million in scal 2005. See also notes 1(l) and 7 to the Consolidated Financial Statements and “Critical

Accounting Policies and Estimates — Valuation of long-lived assets, intangible assets and goodwill”.

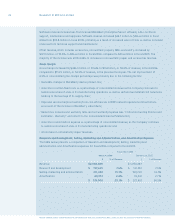

During scal 2005, the Company re-evaluated the estimated useful lives of certain of its information

technology assets and determined that the estimated useful lives should be reduced from ve years to

periods of three to four years. The impact of this change was applied on a prospective basis commencing

in the rst quarter of scal 2005. The impact of this change of accounting estimate resulted in incremental

amortization expense of $4.3 million for the year. Of this amount, $1.8 million was included in Cost of sales,

and $2.5 million was included in Amortization. See also note 1(k) to the Consolidated Financial Statements.

During scal 2005, the Company also re-evaluated the estimated useful lives of capital assets used in

manufacturing, and research and development operations that resulted from the application of the 20%

declining balance amortization methodology. As a result of the plant capacity and capital asset utilizations

currently approaching 100% compared to much lower levels in prior scal years, the Company now

believes that the 20% declining balance method will not produce quarterly and annual depreciation

expense and resulting residual net book values that are consistent with the increased current and future

capital asset usage. The Company, therefore, revised its amortization method to a straight-line method and

determined estimated useful lives to be between ve and eight years for such capital assets, on a

prospective basis, effective the second quarter of scal 2005. The impact of this change of method of

accounting was insignicant for scal years 2006 and 2005. See also notes 2 and 6 to the Consolidated

Financial Statements.

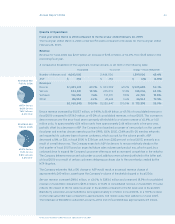

Litigation

As has been more fully disclosed in the Company’s annual consolidated nancial statements and notes

for the scal years ended March 4, 2006, February 26, 2005, February 28, 2004 and March 1, 2003, the

Company was the defendant in a patent litigation matter brought by NTP alleging that the Company

infringed on eight of NTP’s patents.

The matter went to trial in 2002 in the United States District Court for the Eastern District of Virginia

(“the District Court”), and the jury issued a verdict in favor of NTP. In 2003, the District Court ruled on

NTP’s request for an injunction with respect to RIM continuing to sell BlackBerry devices, software and

service in the United States. The District Court granted NTP the injunction requested; however, the

District Court then immediately granted RIM’s request to stay the injunction sought by NTP pending the

completion of RIM’s appeal. In December 2004, the Court of Appeals for the Federal Circuit (the “CAFC”)

ruled on the appeal by the Company of the District Court’s judgment. In August 2005, the CAFC granted

RIM’s request to reconsider the December 2004 decision. The CAFC’s August 2005 decision vacated the

District Court’s judgment and the injunction, and remanded the case to the District Court for further

proceedings consistent with the CAFC’s ruling. Further court proceedings followed.