Blackberry 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

60

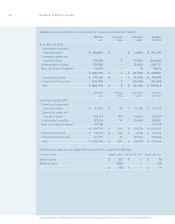

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

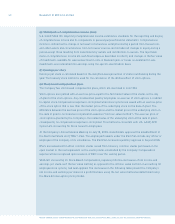

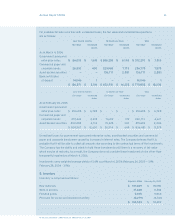

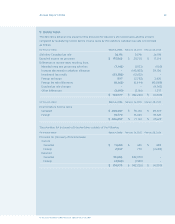

Deferred income tax assets and liabilities consist of the following temporary differences:

As at February 26, 2005

Assets

Financing costs $ 8,727

Non-deductible reserves 7,370

Reserve related to NTP litigation (note 15) 92,837

Research and development incentives 42,920

Tax loss carryforwards 10,009

Other tax carryforwards —

Net deferred income tax assets $ 161,863

Liabilities

Capital assets 4,3 13

Unrealized gains on nancial instruments 5,070

Other tax carryforwards 2,280

11,663

Net deferred income tax $ 150,200

Deferred income tax asset — current $ 150,200

Deferred income tax liability — long-term —

$ 150,200

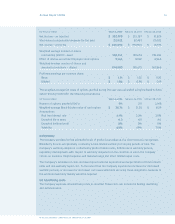

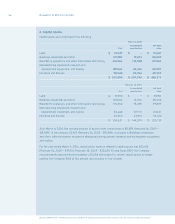

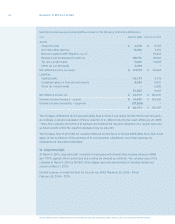

The Company determined that it was more likely than not that it can realize its deferred income tax assets.

Accordingly, a valuation allowance of $nil is required on its deferred income tax assets (February 26, 2005

— $nil). The Company will continue to evaluate and examine the valuation allowance on a regular basis and

as future events unfold the valuation allowance may be adjusted.

The Company has not provided for Canadian deferred income taxes or foreign withholding taxes that would

apply on the distribution of the earnings of its non-Canadian subsidiaries, since these earnings are

intended to be reinvested indenitely.

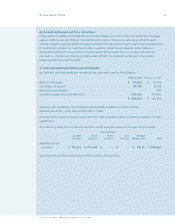

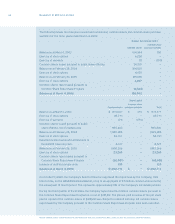

10. Long-term Debt

At March 4, 2006, long-term debt consisted of mortgages with interest rates ranging between 6.88%

and 7.90%, against which certain land and building are pledged as collateral. The carrying value of the

collateral at March 4, 2006 is $10,830. All mortgage loans are denominated in Canadian dollars and

mature on March 1, 2009.

Interest expense on long-term debt for the year was $483 (February 26, 2005 — $460;

February 28, 2004 — $771).