Blackberry 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

58

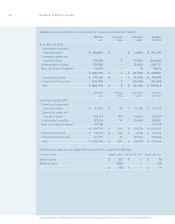

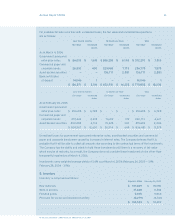

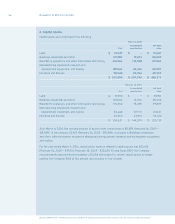

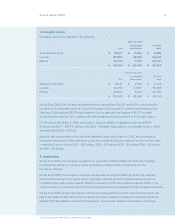

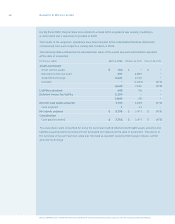

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

During scal 2004, the purchase price related to a scal 2003 acquisition was revised, resulting in

a cash refund and a reduction to goodwill of $478.

The results of the acquirees’ operations have been included in the consolidated nancial statements

commencing from each respective closing date to March 4, 2006.

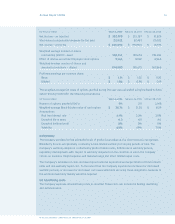

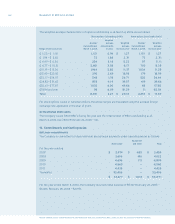

The following table summarizes the estimated fair value of the assets acquired and liabilities assumed

at the date of acquisition:

For the year ended February 26, 2005 February 28, 2004

Other current assets $ — $ —

Deferred income tax asset 2,889 —

Acquired technology 2,140 —

Goodwill (1,083) (478)

3,946 (478)

58 —

— —

58 —

3,888 (478)

Cash acquired 23 —

$ 3,9 1 1 $ (478)

Cash paid (received) $ 3,9 1 1 $ (478)

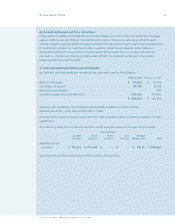

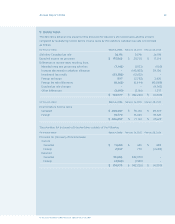

The acquisitions were accounted for using the purchase method whereby identiable assets acquired and

liabilities assumed were recorded at their estimated fair value as of the date of acquisition. The excess of

the purchase price over such fair value was recorded as goodwill. Acquired technology includes current

and core technology.