Blackberry 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Annual Report 2006 59

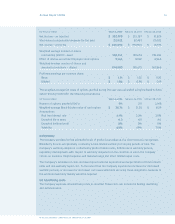

For the years ended March 4, 2006, February 26, 2005 and February 28, 2004

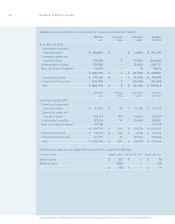

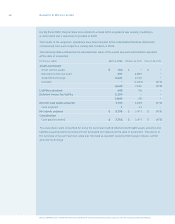

9. Income Taxes

The difference between the amount of the provision for (recovery of) income taxes and the amount

computed by multiplying income before income taxes by the statutory Canadian tax rate is reconciled

as follows:

For the year ended February 26, 2005 February 28, 2004

Statutory Canadian tax rate 36.1% 36.5%

Expected income tax provision $ 25,703 $ 17,394

Differences in income taxes resulting from:

Manufacturing and processing activities (1,053) (900)

Increase (decrease) in valuation allowance (142,852) 29,100

Investment tax credits (13,652) —

Foreign exchange (2,782) 3,820

Foreign tax rate differences (5,444) (45,088)

Enacted tax rate changes — (9,743)

Other differences (2,146) 1,21 7

$ (142,226) $ (4,200)

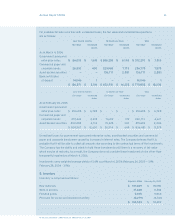

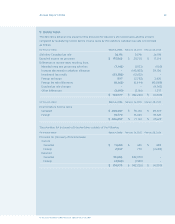

For the year ended February 26, 2005 February 28, 2004

Income before income taxes:

Canadian $ 55,136 $ 29,309

Foreign 16,025 18,320

$ 71, 1 6 1 $ 47,629

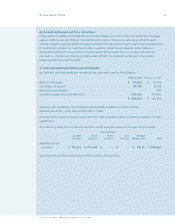

The provision for (recovery of) income taxes consists of the following:

For the year ended February 26, 2005 February 28, 2004

Provision for (recovery of) income taxes:

Current

Canadian $ 655 $ 484

Foreign 770 (4,684)

Deferred

Canadian (142,070) —

Foreign (1,581) —

$ (142,226) $ (4,200)