Blackberry 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

34

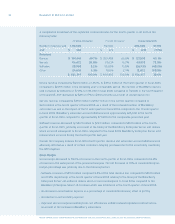

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

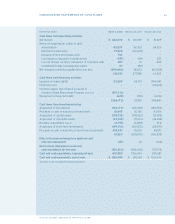

The following table sets out aggregate information about the Company’s contractual obligations and the

periods in which payments are due as at March 4, 2006:

Less than One to Four to Greater than

One Year Three Years Five Years Five Years

Long-term debt $ 262 $ 6,850 $ — $ —

Operating lease obligations 3,459 13,391 8,870 28,971

Purchase obligations

and commitments 323, 176 — — —

Total $ 326,897 $ 20,241 $ 8,870 $ 28,971

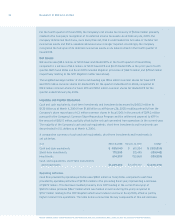

Purchase obligations and commitments of $323.2 million as of March 4, 2006, in the form of purchase

orders or contracts, are primarily for the purchase of raw materials, as well as for capital assets and other

goods and services. The expected timing of payment of these purchase obligations and commitments is

estimated based upon current information. Timing of payment and actual amounts paid may be different

depending upon the time of receipt of goods and services or changes to agreed-upon amounts for some

obligations. The Company may also be liable for certain key suppliers’ component part inventories and

purchase commitments if the Company’s changes to its demand plans adversely affects these certain

key suppliers.

As of March 4, 2006, the Company had commitments on account of capital expenditures of approximately

$8.3 million included in the $323.2 million above, primarily for manufacturing, information technology

including service operations.

The Company intends to fund current and future capital and intangible asset expenditure requirements

from existing nancial resources and cash ows.

The Company has not declared any cash dividends in the last three scal years.

Cash, cash equivalents, short-term investments and investments were $1.25 billion as at March 4, 2006.

The Company believes its nancial resources are sufcient to meet funding requirements for current

nancial commitments, for future operating and capital expenditures not yet committed, and also provide

the necessary nancial capacity to meet current and future growth expectations.

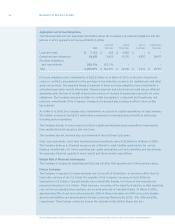

Market Risk of Financial Instruments

The Company is engaged in operating and nancing activities that generate risk in three primary areas:

The Company is exposed to foreign exchange risk as a result of transactions in currencies other than its

functional currency of the U.S. Dollar. The majority of the Company’s revenues in scal 2006 are

transacted in U.S. Dollars, Canadian Dollars, Euros and British Pounds. Purchases of raw materials are

primarily transacted in U.S. Dollars. Other expenses, consisting of the majority of salaries, certain operating

costs and most manufacturing overhead, are incurred primarily in Canadian Dollars. At March 4, 2006,

approximately 5% of cash and cash equivalents, 28% of trade receivables and 19% of accounts payable

and accrued liabilities are denominated in foreign currencies (February 26, 2005 – 2%, 42% and 22%,

respectively). These foreign currencies include the Canadian Dollar, British Pound and Euro.