Blackberry 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

18

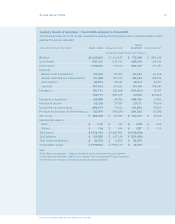

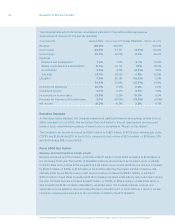

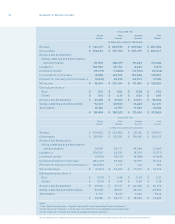

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

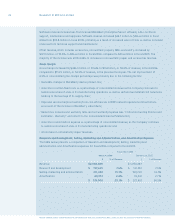

On December 16, 2004, the Financial Accounting Standards Board (“FASB”) issued amended Statement of

Financial Accounting Standards 123 (“SFAS 123(R)”)

Accounting for Share-Based Payments

, which requires

all companies to use the fair-value based method of accounting for stock-based compensation, and is in

effect for all interim periods beginning after June 15, 2005. SFAS 123(R) requires that all companies adopt

either the modied prospective transition (“MPT”) or modied retrospective transition (“MRT”) approach.

Stock compensation expense calculated using the MPT approach would be recognized on a prospective

basis in the nancial statements over the requisite service period, while the MRT method allows a

restatement of prior periods for amounts previously recorded as proforma expense.

On April 14, 2005, the SEC announced that it would provide for a phased-in implementation process for

SFAS 123(R). The Company will now be required to adopt a fair-value based method in the rst quarter

of scal 2007.

At the Company’s Annual General Meeting on July 18, 2005, shareholders approved the establishment of

the Restricted Share Unit (“RSU”) Plan. The eligible participants under the RSU Plan include any ofcer or

employee of the Company or its subsidiaries. RSUs are redeemed for either common shares issued by the

Company, common shares purchased on the open market or the cash equivalent on the vesting dates

established by the Company. Compensation expense, based on the fair value of the Company’s shares at

the date of grant, will be recognized upon issuance of RSUs over the RSU vesting period.

Stock Split

The Company declared an effective two-for-one stock split in the form of a one-for-one stock dividend

payable on June 4, 2004 to all shareholders of record on May 27, 2004. All earnings (loss) per share data

for prior periods have been adjusted to reect this stock split. See “Results of Operations – Net Income”

and note 11(a) to the Consolidated Financial Statements.

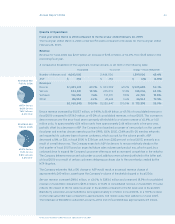

Common Shares Outstanding

On May 3, 2006, there were 186.4 million common shares, 8.5 million stock options to purchase common

shares and 7,800 RSUs outstanding.