Blackberry 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

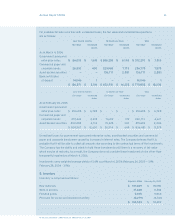

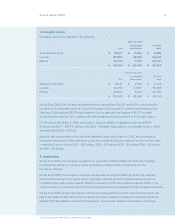

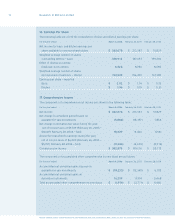

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Annual Report 2006 63

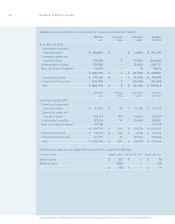

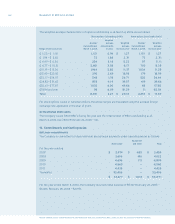

For the years ended March 4, 2006, February 26, 2005 and February 28, 2004

During scal 2005 and as described in note 9, the Company determined that it was more likely than not it

can realize its deferred income tax assets and therefore recognized a deferred income tax asset of $8,727

with respect to scal 2004 share issue nancing costs.

On January 22, 2004, the Company completed a public share issue of 24.2 million common shares for

proceeds of $905,240, net of related issue costs of $39,629.

During scal 2004, the Company’s share purchase warrants were redeemed and converted into

common shares.

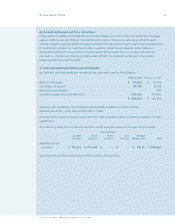

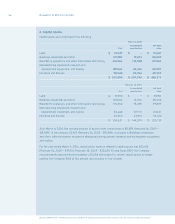

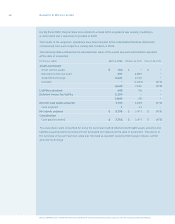

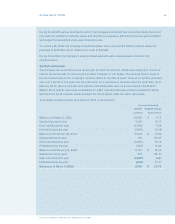

(b) Stock option plan

The Company has an incentive stock option plan for all of its directors, ofcers and employees. The stock

options are issued with an exercise price in either Canadian or U.S. dollars. The exercise price is equal to

the fair market value of the Company’s common shares at the date of grant. These stock options generally

vest over a period of ve years and are exercisable for a maximum of ten years after the grant date. As at

March 4, 2006, there were 8,961 stock options outstanding with exercise prices ranging from $1.22 to

$88.97. Stock options issued and outstanding for 4,253 common shares are vested as at March 4, 2006

and there are 5,638 common shares available for future grants under the stock option plan.

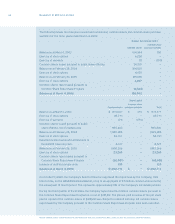

A summary of option activity since March 1, 2003 is shown below:

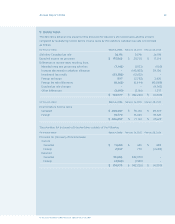

Balance as at March 1, 2003 20,202 $ 9.1 5

Granted during the year 3,148 15. 1 7

Exercised during the year (6,258) 7.06

Forfeited during the year (1,074) 13.98

Balance as at February 28, 2004 16,018 $ 10.82

Granted during the year 315 58.45

Exercised during the year (4,655) 10. 1 9

Forfeited during the year (527) 10.49

Balance as at February 26, 2005 1 1,1 5 1 $ 12.44

Granted during the year

Exercised during the year

Forfeited during the year