Blackberry 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

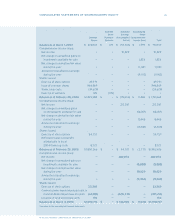

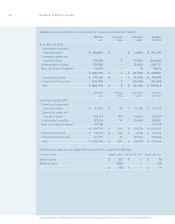

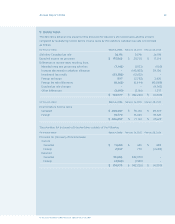

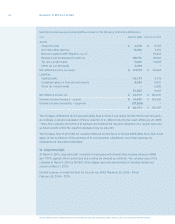

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Annual Report 2006 51

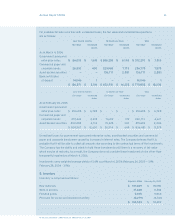

For the years ended March 4, 2006, February 26, 2005 and February 28, 2004

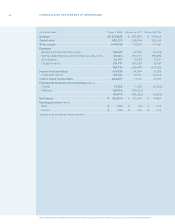

For the year ended February 26, 2005 February 28, 2004

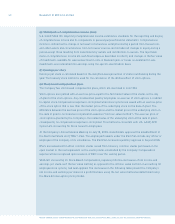

Net income — as reported $ 213,387 $ 51,829

Stock-based compensation expense for the year 22,487 20,033

Net income — proforma $ 190,900 $ 31,796

Weighted average number of shares

outstanding (000’s) — basic 187,653 159,300

Effect of dilutive securities: Employee stock options 8,022 4,568

Weighted-average number of shares and

assumed conversions — diluted 195,675 163,868

Proforma earnings per common share:

Basic $ 1.02 $ 0.20

Diluted $ 0.98 $ 0.19

The weighted average fair value of options granted during the year was calculated using the Black-Scholes

option-pricing model with the following assumptions:

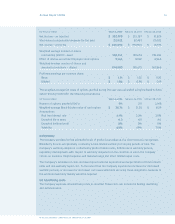

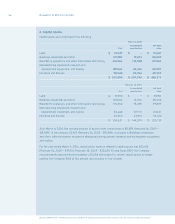

For the year ended February 26, 2005 February 28, 2004

Number of options granted (000’s) 315 3,148

Weighted-average Black-Scholes value of each option $ 31.58 $ 8.29

Assumptions:

Risk free interest rate 3.3% 3.0%

Expected life in years 4.0 4.0

Expected dividend yield 0% 0%

Volatility 69% 70%

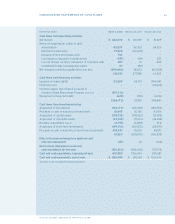

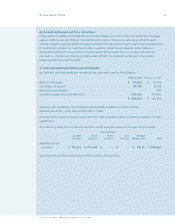

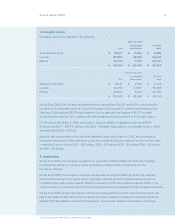

(v) Warranty

The Company provides for the estimated costs of product warranties at the time revenue is recognized.

BlackBerry devices are generally covered by a time-limited warranty for varying periods of time. The

Company’s warranty obligation is affected by product failure rates, differences in warranty periods,

regulatory developments with respect to warranty obligations in the countries in which the Company

carries on business, freight expense, and material usage and other related repair costs.

The Company’s estimates of costs are based upon historical experience and expectations of future return

rates and unit warranty repair cost. To the extent that the Company experiences increased or decreased

warranty activity, or increased or decreased costs associated with servicing those obligations, revisions to

the estimated warranty liability would be required.

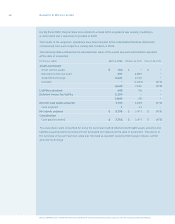

(w) Advertising costs

The Company expenses all advertising costs as incurred. These costs are included in

Selling, marketing

and administration

.