Blackberry 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

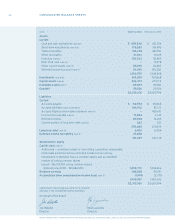

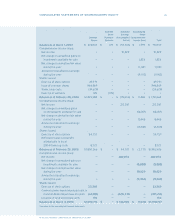

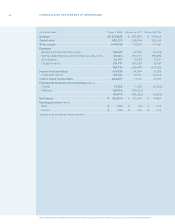

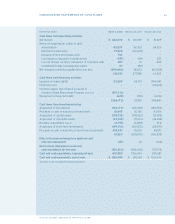

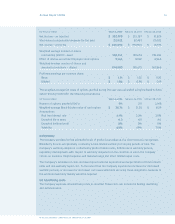

Research In Motion Limited • Incorporated Under the Laws of Ontario (In thousands of United States dollars, except per share data, and except as otherwise indicated)

Annual Report 2006 47

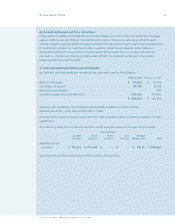

For the years ended March 4, 2006, February 26, 2005 and February 28, 2004

Buildings, leaseholds and other Straight-line over terms between 5 and 40 years

BlackBerry operations and

other information technology Straight-line over terms between 3 and 5 years

Manufacturing equipment, research and

development equipment, and tooling Straight-line over terms between 2 and 8 years

Furniture and xtures 20% per annum declining balance

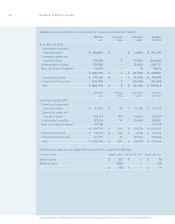

During scal 2005, the Company re-evaluated the estimated useful lives of certain of its information

technology assets and determined that the estimated useful lives should be reduced to periods of three or

four years from ve years. The impact of this change was applied on a prospective basis commencing with

the rst quarter of scal 2005. The impact of this change of accounting estimate resulted in incremental

amortization expense of $4,275 in scal 2005. Of this amount, $1,750 was included in

Cost of sales

, and

$2,525 was included in

Amortization

.

(l) Intangible assets

Intangible assets are stated at cost less accumulated amortization and are comprised of licenses, patents

and acquired technology. Licenses include licenses or agreements that the Company has negotiated with

third parties upon use of third parties’ technology. Patents include all costs necessary to acquire

intellectual property such as patents and trademarks, as well as legal defence costs arising out of the

assertion of any Company-owned patents. Acquired technology consists of purchased developed

technology arising from the Company’s corporate acquisitions.

Intangible assets are amortized as follows:

Acquired technology Straight-line over 2 to 5 years

Licenses Lesser of 5 years or on a per unit basis based

upon the anticipated number of units sold during

the terms of the license agreements

Patents Straight-line over 17 years

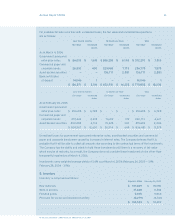

(m) Impairment of long-lived assets

The Company reviews long-lived assets such as property, plant and equipment and intangible assets with

nite useful lives for impairment whenever events or changes in circumstances indicate that the carrying

amount may not be recoverable. If the total of the expected undiscounted future cash ows is less than the

carrying amount of the asset, a loss is recognized for the excess of the carrying amount over the fair value

of the asset.

(n) Goodwill

Goodwill represents the excess of the purchase price of business acquisitions over the fair value of

identiable net assets acquired in such acquisitions. Goodwill is allocated as at the date of the business

combination. Goodwill is not amortized, but is tested for impairment annually, or more frequently if events

or changes in circumstances indicate the asset might be impaired.

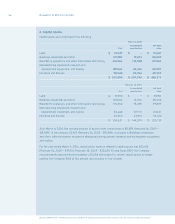

The impairment test is carried out in two steps. In the rst step, the carrying amount of the reporting unit

including goodwill is compared with its fair value. When the fair value of a reporting unit exceeds its carrying

amount, goodwill of the reporting unit is considered not to be impaired, and the second step is unnecessary.