Avon 2000 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

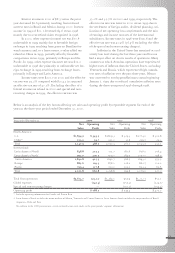

However, Brazil made tremendous improvements in the

operating expense ratio attributable to reduced bad debt

expense, sales returns and transportation costs. Excluding

the impact of foreign currency exchange, operating profit

in Latin America increased 22% over 1998.

The Brazilian real devalued significantly in

January 1999 and, as a result, negatively affected Brazil’s

u.s. dollar results in 1999. The effect of exchange rates

was reduced by foreign exchange contracts previously

in place and several actions taken by local management

to offset the devaluation, including a focused effort

directed at vendor negotiations and additional local

sourcing to reduce imports. Brazil’s 1999 sales, although

up over 20% in local currency, were down approximately

20% in u.s. dollars due to the devaluation.

In the Europe region, sales increased 2% to $878.0

and operating profit increased 23% to $126.2 in 1999.

Sales growth in Central Europe, primarily Poland, and

the United Kingdom was partially offset by declines

in Russia, Germany and France. Continued double-

digit increases in units, customers served and active

Representatives contributed to Central Europe’s sales

increase. Poland’s success reflects strong growth in the

cft category, increased Representative retention and a

change in the campaign cycle, including a new brochure

every four weeks versus six weeks in 1998. Growth in the

United Kingdom resulted from a higher average order

size, increased distributorship sales and the successful

launch of a new brochure in 1999 to enhance Avon’s

image. Sales were lower in Russia due to the economic

crisis and ruble devaluation, which occurred in August

1998, and in Germany due to a weak economy. Local

currency sales in Russia increased almost 30% over

1998, with a strong increase in active Representatives.

Excluding the impact of foreign currency exchange, sales

in Europe increased 13% over 1998. The increase in

Europe’s operating profit resulted from operating margin

improvements in Central Europe, mainly Poland, the

United Kingdom and Italy due to higher gross margins

that resulted from a continuing focus on pricing strate-

gies and improved profitability of non-cft categories.

These operating profit increases were partially offset by

continued declines in Russia due to the ruble devaluation.

Management in Russia will continue to focus on market

share growth and improved margins through pricing flex-

ibility and tight expense management. Excluding the

impact of foreign currency exchange, operating profit

increased 31% over 1998.

In the Pacific region, sales increased 16% to $720.1

and operating profit increased 63% to $102.1 in 1999.

Excluding the impact of foreign currency exchange, sales

increased 8% over 1998. The sales improvement resulted

from growth in every market, most significantly in Japan

due to a favorable currency impact in 1999, and in the

Philippines, Taiwan and Australia due to strong increases

in units and customers served. Despite the earthquake in

Taiwan in September 1999, sales were up double-digits

over 1998 due to aggressive marketing and sales pro-

grams, incentive offers and increased spending on adver-

tising. The increase in the region’s operating profit

resulted primarily from the above sales increases and

operating margin improvements in Japan and China.

Japan’s gross margin improved due to product cost sav-

ings initiatives in cft and improved sourcing decisions

for non-cft as well as a profitability screening process

that led to the elimination of many low-margin products

in the apparel and jewelry segments. Additionally, bpr

efforts continue to generate significant savings across all

expense areas in Japan. China’s operating margin also

improved significantly in 1999 reflecting the suspension

of operations for most of the second quarter of 1998.

Excluding the impact of foreign currency exchange, oper-

ating profit increased 53% over 1998.

See Foreign Operations section under Liquidity and

Capital Resources for additional discussion.

Global Expenses > Global expenses were $242.3 in 2000

compared with $255.3 in 1999. The $13.0 decrease was

primarily due to lower expenses related to the Company’s

long-term incentive plan, lower benefit expenses, insur-

ance proceeds received in 2000 related to the 1998 hurri-

cane losses in Central America, the 1999 flood losses in

Venezuela and 1999 earthquake losses in Taiwan, and sav-

ings in global marketing departments, partially offset by

increased investments in information technology and

retail initiatives. In 1999, global expenses were $30.8

higher than 1998 due to higher spending related to global

marketing and information technology system initiatives.

39