Avon 2000 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

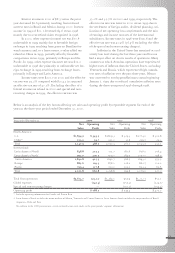

Risk Management Strategies and Market Rate Sensitive

Instruments > The Company operates globally, with manu-

facturing and distribution facilities in various locations

around the world. The Company may reduce its primary

market exposures to fluctuations in interest rates and

foreign exchange rates by creating offsetting positions

through the use of derivative financial instruments. The

Company does not use derivative financial instruments

for trading or speculative purposes, nor is the Company

a party to leveraged derivatives.

The Company periodically uses interest rate swaps

to hedge portions of interest payable on its debt. In addi-

tion, the Company may periodically employ interest rate

caps to reduce exposure, if any, to increases in variable

interest rates.

The Company may periodically hedge foreign

currency royalties, net investments in foreign subsidi-

aries, firm purchase commitments and contractual foreign

currency cash flows or obligations, including third party

and intercompany foreign currency transactions. The

Company regularly monitors its foreign currency expo-

sures and ensures that hedge contract amounts do not

exceed the amounts of the underlying exposures.

At December 31, 2000, the Company held foreign

currency forward contracts with notional amounts total-

ing $393.7 and option contracts with notional amounts

totaling $19.1 to hedge foreign currency items. All

of these contracts mature within the next 13 months.

Also outstanding in 2000 were foreign currency forward

contracts totaling $34.2, which do not qualify as hedg-

ing transactions under the current accounting definitions

and, accordingly, have been marked to market. The

mark-to-market adjustment at December 31, 2000 was

not material.

The Company has entered into forward contracts

to purchase approximately 1,374,400 shares of Avon

common stock at an average price of $37.09 per share at

December 31, 2000. The contracts mature over the next

ten months and provide for physical or net share settle-

ment to the Company. Accordingly, no adjustment for

subsequent changes in fair value has been recognized. In

accordance with the provisions of eitf 00-19, $51.0 of

these contracts have been included in the accompanying

Consolidated Balance Sheets in Share repurchase commit-

ments with a corresponding decrease in Additional

paid-in capital. See Note 2of the Notes to Consolidated

Financial Statements. On March 1, 2001, the Company

purchased 260,000 shares of Avon common stock at a

purchase price of $11.5 under these contracts.

The Company attempts to minimize its credit

exposure to counterparties by entering into interest rate

swap and cap contracts only with major international

financial institutions with “a” or higher credit ratings as

issued by Standard & Poor’s Corporation. The Company’s

foreign currency and interest rate derivatives are com-

prised of over-the-counter forward contracts or options

with major international financial institutions. Although

the Company’s theoretical credit risk is the replacement

cost at the then estimated fair value of these instruments,

management believes that the risk of incurring losses is

remote and that such losses, if any, would not be material.

Non-performance of the counterparties to the bal-

ance of all the currency and interest rate swap agreements

would not result in a significant write off at December 31,

2000. In addition, Avon may be exposed to market risk

on its foreign exchange and interest rate swap agreements

as a result of changes in foreign exchange and interest

rates. The market risk related to the foreign exchange

agreements should be substantially offset by changes in

the valuation of the underlying items being hedged.

The Company is exposed to changes in financial

market conditions in the normal course of its operations,

primarily due to international businesses and transactions

denominated in foreign currencies and the use of various

financial instruments to fund ongoing activities.

Various derivative and non-derivative financial

instruments held by the Company are sensitive to changes

in interest rates. These financial instruments are either

discussed above or in Notes 4and 7of the Notes to

Consolidated Financial Statements. Interest rate changes

would result in gains or losses in the fair value of debt

and other financing instruments held by the Company.

Based on the outstanding balance of all instruments at

December 31, 2000, a hypothetical 50 basis point

increase or decrease in interest rates prevailing at this

date, sustained for one year, would not represent a mate-

rial potential loss in fair value, earnings or cash flows.

This potential loss was calculated based on discounted

cash flow analyses using interest rates comparable to the

Company’s current cost of debt. In 2000, the Company

did not experience a material loss in fair value, earnings

or cash flows associated with changes in interest rates.

The Company is exposed to equity price fluctua-

tions for investments included in the grantors trust.

A 10% change in equity prices would not be material

based on the fair value of equity investments as of

December 31, 2000.

44