Avon 2000 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

8Stock Option Plans

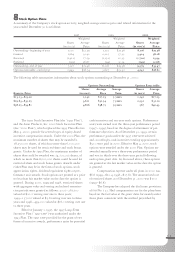

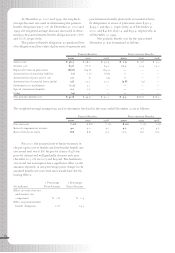

A summary of the Company’s stock option activity, weighted-average exercise price and related information for the

years ended December 31 is as follows:

1998 1999 2000

Weighted Weighted Weighted

Shares Average Shares Average Shares Average

(in 000’s) Price (in 000’s) Price (in 000’s) Price

Outstanding– beginning of year 7,070 $22.29 7,127 $25.46 8,106 $29.38

Granted 1,664 32.40 2,225 37.33 3,424 38.28

Exercised (1,412) 17.59 (1,152) 20.35 (1,702) 23.94

Forfeited (195) 26.87 (94) 31.14 (249) 31.68

Outstanding– end of year 7,127 $25.46 8,106 $29.38 9,579 $33.47

Options exercisable– end of year 2,943 $18.74 3,627 $23.32 4,241 $28.61

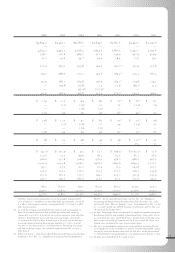

The following table summarizes information about stock options outstanding at December 31, 2000:

Options Outstanding Options Exercisable

Shares Average Average Shares Average

Exercise Price (in 000’s) Price Term (in 000’s) Price

$13.13– $23.00 1,142 $17.23 5 years 1,142 $17.23

$29.63– $35.25 3,611 $31.54 7 years 2,532 $31.10

$38.25– $54.81 4,826 $38.75 9 years 567 $40.43

The 1993 Stock Incentive Plan (the “1993 Plan”),

and the Avon Products, Inc. 2000 Stock Incentive Plan

(the “2000 Plan”), which replaced the 1993 Plan effective

May 4, 2000, provide for several types of equity-based

incentive compensation awards. Under the 2000 Plan, the

maximum number of shares that may be awarded is

18,250,000 shares, of which no more than 6,000,000

shares may be used for restricted share and stock bonus

grants. Under the 1993 Plan, the maximum number of

shares that could be awarded was 14,100,000 shares, of

which no more than 8,000,000 shares could be used for

restricted share and stock bonus grants. Awards under

either Plan may be in the form of stock options, stock

appreciation rights, dividend equivalent rights or per-

formance unit awards. Stock options are granted at a price

no less than fair market value on the date the option is

granted. During 2000, 1999 and 1998, restricted shares

with aggregate value and vesting and related amortiza-

tion periods were granted as follows: 2000–261,700

valued at $10.2 vesting over one to three years;

1999 –137,000 valued at $5.8 vesting over one to three

years and 1998 –499,000 valued at $16.0 vesting over one

to three years.

Effective January 1, 1997, the 1997 Long-Term

Incentive Plan (“1997 ltip”) was authorized under the

1993 Plan. The 1997 ltip provided for the grant of two

forms of incentive awards, performance units for potential

cash incentives and ten-year stock options. Performance

units were earned over the three-year performance period

(1997–1999), based on the degree of attainment of per-

formance objectives. As of December 31, 1999, certain

performance goals under the 1997 ltip were achieved

and, accordingly, cash incentives totaling approximately

$31.0 were paid in 2000. Effective May 4, 2000, stock

options were awarded under the 2000 Plan. Options are

awarded annually over a three-year performance period

and vest in thirds over the three-year period following

each option grant date. As discussed above, these options

are granted at the fair market value on the date the option

is granted.

Compensation expense under all plans in 2000 was

$6.6 (1999 –$20.4; 1998–$17.8). The unamortized cost

of restricted shares as of December 31, 2000 was $10.0

(1999 –$6.8).

The Company has adopted the disclosure provisions

of fas No. 123. Had compensation cost for the plans been

based on the fair value at the grant dates for awards under

those plans consistent with the method prescribed by