Avon 2000 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

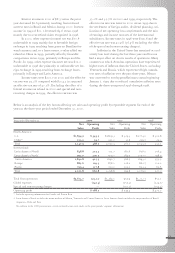

2000 Compared to 1999

North America > Net sales in North America increased

5% to $2.15 billion in 2000. The u.s. business, which

represents almost 90% of the North American segment,

reported sales growth of 5%. The sales increase in the

u.s. resulted primarily from a 6% increase in the number

of units sold, a 2% increase in active Representatives and

a higher average cft order size. Sales improvements in

the u.s. resulted from increases in cft categories, fash-

ion jewelry and watches and accessories, partially offset

by declines in apparel and home entertainment products.

u.s. sales of cft increased 7% over 1999 reflecting a

double-digit increase in skincare, primarily due to strong

launches of Botanisource and Anew Retroactive, which was

the largest cft launch ever. Color cosmetics also reported

double-digit increases versus prior year, reflecting our

commitment to the Avon Color brand and powerful new

product introductions, such as Nailwear and Glazewear.

Growth in the fragrance category was driven by strong

performance in Men’s brands. The personal care category

also contributed to the sales increase, particularly from

the strength of the new launch of Chamomile and sales of

existing Skin-So-Soft lines, which reported the largest

increases ever for this brand. Fashion jewelry and watches

increased mid-single digits versus 1999 due to strategic

growth in fashion and fine jewelry segments. Higher

sales in accessories were driven by strong performance in

fashion accessories, including handbags, totes and small

leather goods. These increases were partially offset by

declines in the apparel category, due to softness in casual

wear items, and lower sales in home entertainment prod-

ucts, resulting from fewer new product introductions.

Operating profit in North America increased

2% to $368.2 in 2000 due to the region’s increased

sales, discussed above, while the operating margin

declined 0.5 points. The decline in operating margin is

primarily due to an increase in the operating expense

ratio in Puerto Rico caused by higher transitional

expenses related to the consolidation of operations.

Gross margin in North America remained level in 2000

as compared to 1999. Operating profit in the u.s. of

$343.5 increased 4% versus 1999 reflecting sales growth,

partially offset by a slightly unfavorable expense ratio.

The expense ratio in the u.s. was negatively impacted

by asset writedowns associated with the closure of certain

Company-owned Avon Beauty Centers. Excluding the

asset writedowns, the expense ratio was favorable to 1999

resulting from cost containment, bpr savings and lower

benefit expenses partially offset by increased spending on

advertising and e-commerce initiatives.

International > International sales increased 9% to $3.53

billion and operating profit increased 11% to $662.8 in

2000. Excluding the effect of foreign exchange, interna-

tional sales increased 14% in 2000 with double-digit

increases in all regions.

In Latin America, sales increased 12% to $1.84

billion in 2000 driven by improvements in all major

markets, with Mexico, Brazil and Venezuela being the

main contributors. Excluding the impact of foreign

exchange, sales in Latin America increased 15% in 2000.

Units and active Representatives for the region rose 4%

and 10%, respectively, versus the same period in 1999.

The sales growth in Mexico was driven by increases in

the number of units sold, active Representatives and

customers served. Mexico had double-digit sales growth

in all product categories, particularly in the cft cate-

gory, as well as in apparel, as a result of greater product

selection. In Brazil, higher average orders, along with

increased prices and more Representatives were the main

drivers of sales improvements. Venezuela’s sales improve-

ment resulted from increases in the number of units sold,

orders, active Representatives and customers served.

Venezuela was able to post these increases despite severe

flooding in late 1999, which negatively affected opera-

tions at the beginning of 2000, along with persistent eco-

nomic and political uncertainty.

Operating profit in Latin America grew 13%

to $415.5 in 2000 due to the sales increases, discussed

above, and operating margin improvements in Venezuela

and Brazil, partially offset by a decline in Argentina. The

operating margin in 2000 in Latin America improved

20 basis points versus 1999. Venezuela’s operating

margin reflected a higher gross margin, driven by price

increases and cost improvement, partially offset by

increased marketing spending and incentive programs.

Brazil’s operating margin increased primarily due to

lower bad debt and recognition expenses. Mexico’s operat-

ing margin remained level with 1999 due to savings in

marketing and cost savings on purchase orders, offset by

a decrease in gross margin due to increased sales of lower

margin items and selective pricing cuts. In Argentina,

operating margin declined as incentives and advertising

expenses were increased to solidify our leading market

position in a weak economic environment.

36