Avon 2000 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

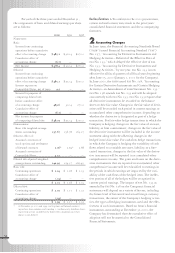

1Description of the Business and Summary of

Significant Accounting Policies

Business

Avon Products, Inc. (“Avon” or the “Company”) is a

global manufacturer and marketer of beauty and related

products. The product categories include cosmetics, fra-

grance and toiletries (“cft”); Beauty Plus which consists

of jewelry, watches and accessories and apparel; and

Beyond Beauty which consists of gift and decorative,

home entertainment and health and nutrition products.

Avon’s business is primarily comprised of one industry

segment, direct selling, which is conducted in North

America, Latin America, the Pacific and Europe. Sales are

made to the ultimate customers principally by independ-

ent Avon Representatives.

Significant Accounting Policies

Principles of Consolidation > The consolidated financial

statements include the accounts of Avon and its majority

and wholly-owned subsidiaries. Intercompany balances

and transactions are eliminated. These statements have

been prepared in conformity with generally accepted

accounting principles and require management to make

estimates and assumptions that affect amounts reported

and disclosed in the financial statements and related

notes. Actual results could differ from these estimates.

Foreign Currency > Financial statements of foreign sub-

sidiaries operating in other than highly inflationary

economies are translated at year-end exchange rates for

assets and liabilities and average exchange rates during

the year for income and expense accounts. The resulting

translation adjustments are recorded within accumulated

other comprehensive income. Financial statements of sub-

sidiaries operating in highly inflationary economies are

translated using a combination of current and historical

exchange rates and any translation adjustments are

included in income.

Revenue Recognition > Avon recognizes revenue upon

delivery, when both title and risks and rewards of owner-

ship pass to the independent Representatives, who are

Avon’s customers. Prior to 2000, Avon recognized rev-

enue as shipments were made. See Note 2 of the Notes to

Consolidated Financial Statements.

Other revenues include shipping and handling fees

charged to Representatives.

Cash and Equivalents > Cash equivalents are stated at cost

plus accrued interest, which approximates fair value. Cash

equivalents are highly liquid debt instruments with an

original maturity of three months or less and consist of

time deposits with a number of u.s. and non-u.s. com-

mercial banks with high credit ratings.

Inventories > Inventories are stated at the lower of cost or

market. Cost is determined using the first-in, first-out

(“fifo”) method for all inventories. Prior to October

1999, substantially all u.s. inventories, except apparel,

used the last-in, first-out (“lifo”) method to determine

cost. The lifo value of such inventory at December 31,

1999 was approximately $3.6 lower than it would have

been under the fifo method at December 31, 1998.

Effective October 1, 1999, the u.s. inventories using the

lifo method were changed to the fifo method. The

change was made because the Company had begun to

realize and expects to continue to experience cost reduc-

tions as a result of technological advancements and

process improvements in its manufacturing operations.

As a result, the fifo method will better measure the cur-

rent value of such inventories, provide a more appropriate

matching of revenues and expenses, and conform all

inventories of the Company to the same accounting

method. This accounting change was not material to the

financial statements on an annual or quarterly basis, and

accordingly, no restatement of prior periods’ financial

statements was made.

Notes to Consolidated Financial Statements

Avon Products, Inc.

In millions, except per share data