Avon 2000 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

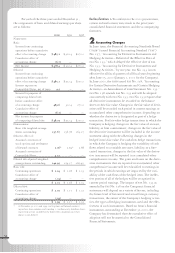

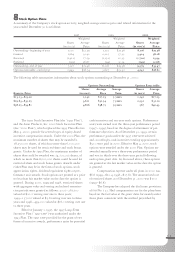

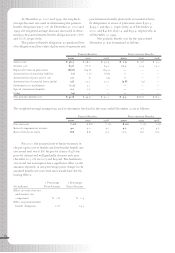

fas No. 123, net income and earnings per share (after the

cumulative effect of the accounting change) would have

been the pro forma amounts indicated below:

2000 1999 1998

Pro forma net income $460.9 $291.0 $263.0

Pro forma earnings per share:

Basic $1.94 $ 1.13 $ 1.00

Diluted $1.92 $ 1.12 $ .99

The fair value for these options was estimated at

the date of grant using a Black-Scholes option pricing

model with the following weighted-average assumptions:

2000 1999 1998

Risk-free interest rate 6.7% 5.4% 5.5%

Expected life 5years 5years 5years

Expected volatility 40% 30% 25%-30%

Expected dividend yield 2.0% 2.0% 2.0%

The weighted-average grant date fair values of

options granted during 2000, 1999 and 1998 were

$11.73, $10.09, and $7.67, respectively.

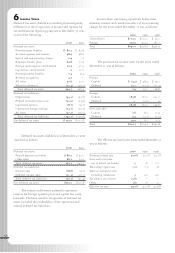

9Shareholders’ (Deficit) Equity

Stock Split > On July 22, 1998, the Company declared a

two-for-one stock split in the form of a 100% stock divi-

dend which was distributed in September 1998 to share-

holders of record as of the close of business on August 24,

1998. Accordingly, the stock split has been recognized by

reclassifying the par value of the additional shares result-

ing from the split from retained earnings to common

stock and treasury stock. All references to the number of

share and per share amounts elsewhere in the consolidated

financial statements and related footnotes have been restated

to reflect the effect of the split for all periods presented.

Share Rights Plan > Avon has a Share Rights Plan under

which one right has been declared as a dividend for each

outstanding share of its common stock. Each right, which

is redeemable at $.005 at any time at Avon’s option, enti-

tles the shareholder, among other things, to purchase one

share of Avon common stock at a price equal to one-half

of the then current market price, if certain events have

occurred. The right is exercisable if, among other events,

one party obtains a beneficial ownership of 20% or more

of Avon’s voting stock.

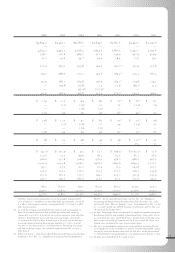

Stock Repurchase Programs > During 1994, Avon’s Board

authorized a stock repurchase program under which Avon

could buy back up to 10% of its then outstanding com-

mon stock, or approximately 28.0 million shares. As of

February 1997, when the plan ended, the cumulative

number of shares repurchased was 25.3 million shares at a

total cost of $424.4 which are included in Treasury stock.

In February 1997, Avon’s Board authorized a new repur-

chase program under which the Company was authorized

to buy back up to $1,100.0 of its currently outstanding

common stock through open market purchases over a

period of up to five years. In the third quarter of 2000,

when the program was completed, the cumulative num-

ber of shares repurchased was 33.7 million shares at a

total cost of $1,060.0. In September 2000, Avon’s Board

approved a new share repurchase program under which

the Company may buy up to $1,000.0 of its outstanding

stock over the next five years. As of December 31, 2000,

the Company repurchased approximately 0.6 million

shares at a total cost of approximately $25.8 under this

new program.

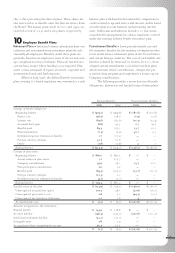

Savings Plan > The Company offers a qualified defined

contribution plan, the Avon Products, Inc. 401(k)

Personal Savings Account, which allows eligible partici-

pants to contribute 1% to 20% of qualified compensation

through payroll deductions. Effective July 1, 1998, the

Company matches employee contributions dollar for dol-

lar up to the first 3% of eligible compensation and $.50

for each $1.00 contributed from 4% to 6% of eligible

compensation. Prior to July 1, 1998, the Company

matched contributions in an amount equal to 25% of an

employee’s qualified contribution. In 2000 and 1999,

matching contributions approximating $12.7 and $12.8,

respectively, were made in cash, which was then used to

purchase Avon shares in the open market. In 1998, Avon

contributed 62,520 shares of treasury stock to the

employees’ savings plan and recognized expense for its

fair value.

Board of Directors Remuneration > Effective May 1, 1997,

the Company discontinued the Board retirement plan,

which was applicable only to non-management directors.

Directors retiring after that date have had the actuarial

value of their accrued retirement benefits converted to a

one-time grant of common stock which is restricted as to

transfer until retirement. 52,786 shares were issued to

directors as a result of the discontinuance of the plan. As a

replacement for such plan, effective on and after May 1,

1997, each non-management director is annually granted

options to purchase 4,000 shares of common stock, at an

exercise price based on the fair market price of the stock

on the date of grant. The annual grant made in 2000 and

1999 consisted of 34,000 and 36,000 options, respectively,

with an exercise price of $38.25 and $51.38, respectively.

Also effective as of May 1, 1997, the annual retainer

paid to non-management directors was changed to consist

of twenty-five thousand dollars cash plus an annual grant

of shares having a value of twenty-five thousand dollars

based on the average closing market price of the stock for