Avon 2000 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

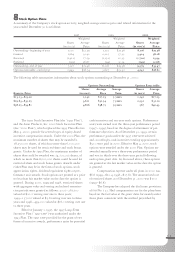

Eleven-Year Review

Avon Products, Inc.

In millions, except per share and employee data

70

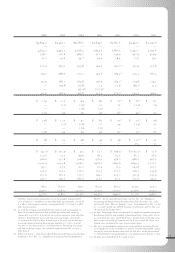

(1) For the year ended December 31, 2000, the Company adopted the provisions

of Emerging Issues Task Force (“eitf”) 00-10, “Accounting for Shipping

and Handling Fees and Costs,” which requires that amounts billed to cus-

tomers for shipping and handling fees be classified as revenues. 1999 and

1998 have been restated to reflect shipping and handling fees, previously

reported in Marketing, distribution and administrative expenses, in Other

revenue in the Consolidated Statements of Income.

(2) For the year ended December 31, 2000, the Company recorded a charge of

$6.7 million, after tax, to reflect the adoption of Staff Accounting Bulletin

(“sab”) No. 101, “Revenue Recognition in Financial Statements.” This

charge is reflected as a cumulative effect of an accounting change in the

Consolidated Statements of Income.

(3) For purposes of calculating diluted earnings per share for the year ended

December 31 , 2000, after tax interest expense of $4.5, applicable to

Convertible Notes, has been added back to net income.

(4) Certain reclassifications have been made to conform to the current full year

presentation.

(5) Two-for-one stock splits were distributed in September 1998 and June 1996.

All per share data in this report, unless indicated, have been restated to

reflect the splits.

(6) Effective for the year ended December 31, 1997, the Company adopted fas

No. 128, “Earnings per Share.” fas No. 128 establishes standards for com-

puting and presenting earnings per share (“eps”) and replaces the presenta-

tion of previously disclosed eps with both basic and diluted eps. Based

upon the Company’s capitalization structure, the eps amounts calculated

in accordance with fas No. 128 approximated the Company’s eps amounts

in accordance with Accounting Principles Board Opinion No. 15, “Earnings

per Share.” All prior period eps data have been restated in accordance with

fas No. 128.

(7) Avon’s calculation of full-time equivalents, or number of employees,

was revised in 1999. Restatements of prior year data are not available, and

2000 1999 1998 1997

Income data

Net sales $5,673.7 $5,289.1 $5,212.7 $ 5,079.4

Other revenue 40.9(1) 38.8(1) 35.0(1) —

Total revenue 5,714.6 5,327.9 5,247.7 5,079.4

Operating profit (4) 788.7 549.4 473.2 537.8

Interest expense (4) 84.7 43.2 34.7 35.5

Income from continuing operations before taxes, minority interest

and cumulative effect of accounting changes 691.0 506.6(8) 455.9(8) 534.9

Income from continuing operations before minority interest and

cumulative effect of accounting changes 489.3 302.4(8) 265.1(8) 337.0

Income from continuing operations before cumulative effect of

accounting changes 485.1 302.4(8) 270.0(8) 338.8

(Loss) income from discontinued operations, net ————

Cumulative effect of accounting changes, net (6.7)(2) ———

Net income 478.4 302.4(8) 270.0(8) 338.8

Earnings (loss) per share– basic (5) (6)

Continuing operations $2.04 $ 1.18(8) $1.03

(8) $1.28

Discontinued operations ————

Cumulative effect of accounting changes (.03) ———

Net income 2.01 1.18(8) 1.03(8) 1.28

Earnings (loss) per share– diluted (5) (6)

Continuing operations $2.02

(3) $1.17

(8) $1.02

(8) $1.27

Discontinued operations ————

Cumulative effect of accounting changes (.03) ———

Net income 1.99(3) 1.17(8) 1.02(8) 1.27

Cash dividends per share

Common $ .74 $ .72 $ .68 $ .63

Preferred ————

Balance sheet data

Working capital $ 186.4 $ (375.0) $ 11.9 $ (11.9)

Capital expenditures 193.5 203.4 189.5 169.4

Property, plant and equipment, net 768.4 734.8 669.9 611.0

Total assets 2,826.4 2,528.6 2,433.5 2,272.9

Debt maturing within one year 105.4 306.0 55.3 132.1

Long-term debt 1,108.2 701.4 201.0 102.2

Total debt 1,213.6 1,007.4 256.3 234.3

Shareholders’ (deficit) equity (215.8) (406.1) 285.1 285.0

Number of employees

United States 9,800 9,700 8,000 8,100

International 33,200 30,800 25,900 26,900

Total employees(7) 43,000 40,500 33,900 35,000