Avon 2000 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The 1999 writedown of assets (primarily fixed

and other assets) relates to the restructuring of operations

in Western Europe, including the closure of a jewelry

manufacturing facility in Ireland, and the writedown of

software, the use of which is no longer consistent with

the strategic direction of the Company. By centralizing

certain key functional areas and exiting unprofitable situ-

ations, the Company plans to increase operating efficien-

cies and, ultimately, profit growth in the long term. The

1998 writedown of assets relates to the closure of a Far

East buying office and manufacturing facilities in Puerto

Rico and the Dominican Republic. As a result of ongoing

government restrictions, the Company has also decided to

close certain branches and a regional office in China. Also,

writedowns include assets (primarily fixed and intangible

assets) associated with the divestiture of the Discovery

Toys business unit, which was effective January 15, 1999.

The field program buy-out represents costs to ter-

minate the Company’s prior representative recruitment

program in the u.s.

The recognition of a foreign currency translation

adjustment relates to the closure of the jewelry manufac-

turing facility in Ireland.

“Other” category primarily represents lease and

contract termination costs, litigation costs, and other

costs associated with the facility closures.

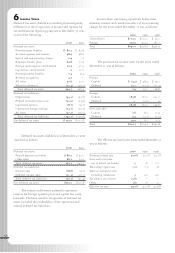

The liability balance included in other accrued lia-

bilities as of December 31, 2000 and 1999, is as follows:

Cost of

Special Sales

Charges Charge Total

Balance at December 31, 1998 $ 28.5 $ — $ 28.5

Provision 105.2 46.0 151.2

Cash expenditures (67.1) — (67.1)

Non-cash write-offs (40.4) (46.0) (86.4)

Balance at December 31, 1999 26.2 — 26.2

Cash expenditures (18.3) — (18.3)

Balance at December 31, 2000 $ 7.9 $ — $ 7.9

The balance at December 31, 2000, relates prima-

rily to employee severance costs that will be paid in accor-

dance with the original plan during 2001.

14 Contingencies

Various lawsuits and claims (asserted and unasserted),

arising in the ordinary course of business or related to

businesses previously sold, are pending or threatened

against Avon.

In 1991, a class action lawsuit was initiated against

Avon on behalf of certain classes of holders of Avon’s

Preferred Equity-Redemption Cumulative Stock (“percs”).

This lawsuit alleges various contract and securities law

claims relating to the percs (which were fully redeemed

that year). While it is not possible to predict the outcome

of litigation, Avon has rejected the assertions in this case,

believes it has meritorious defenses to the claims and is

vigorously contesting this lawsuit. It is anticipated that a

trial may take place in late 2001.

In the opinion of Avon’s management, based on

its review of the information available at this time, the

total cost of resolving such contingencies at December 31,

2000 should not have a material adverse impact on Avon’s

consolidated financial position, results of operations or

cash flows.

As disclosed in a Form 8-k filed September 14,

2000, in response to a private investigation by the

Securities and Exchange Commission, the Company

is providing information that principally concerns an

item included in its special charge reported for the first

quarter of 1999. The item consists of an order manage-

ment software system for sales representatives known as

the first project, of which $15 million in costs were

written off as part of the special charge. The balance of

the project’s development costs, amounting to approxi-

mately $25 million, continue to be carried as an asset

on the books of the Company.

The Company is fully cooperating with the sec.

The sec has stated that its inquiry should not be con-

strued as an indication by the Commission or its staff that

any violations of law have occurred, nor should it be con-

sidered a reflection upon any person, entity or security.

The outcome of this investigation cannot be predicted.

15 Subsequent Event

On February 1, 2001, Avon’s Board approved an increase

in the quarterly cash dividend to $.19 per share from

$.185. The first dividend at the new rate will be paid on

March 1, 2001, to shareholders of record on February 15,

2001. On an annualized basis, the new dividend rate will

be $.76 per share.

68