Avon 2000 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

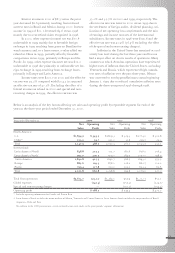

Capital Resources > Total debt of $1,213.6 at December

31, 2000 increased $206.2 from $1,007.4 at December

31, 1999, compared with an increase of $751.1 from

December 31, 1998. At December 31 , 1999, other accrued

liabilities included approximately $106.4, related to secu-

rities lending activities. These liabilities were repaid in

2000. See Note 4of the Notes to Consolidated Financial

Statements for further discussion of these transactions.

During 2000 and 1999, cash flows from operating activi-

ties combined with cash on hand and higher debt levels

were used for repurchase of common stock, dividends,

capital expenditures and the acquisition of a manufactur-

ing facility in Poland in 1999.

At December 31, 2000, debt maturing within one

year consisted of borrowings from banks of $104.6 and

the current maturities of long-term debt of $.8. Manage-

ment believes that cash from operations and available

sources of financing are adequate to meet anticipated

requirements for working capital, dividends, capital

expenditures, the remainder of the stock repurchase pro-

gram and other cash needs.

In July 2000, the Company issued in a private

placement $735.8 principal amount at maturity of zero

coupon convertible senior notes (“Convertible Notes”)

due July 12, 2020, with proceeds of approximately

$350.0. The issue price per note was $475.66, being

47.566% of the principal amount of $1,000 per note at

maturity. The Convertible Notes have a 3.75% yield

to maturity and are convertible at any time into the

Company’s common stock at a conversion rate of 8.2723

shares of common stock per $1,000 principal amount at

maturity of the Convertible Notes (equivalent to a con-

version price of $57.50 per share based on the initial

offering price of the Convertible Notes). The Convertible

Notes may be redeemed at the option of the Company on

or after July 12, 2003, at a redemption price equal to the

issue price plus accrued original issue discount to the

redemption date. The holders can require the Company

to purchase all or a portion of the Convertible Notes on

July 12, 2003, July 12, 2008 and July 12, 2013, at the

redemption price per note of $531.74, $640.29 and

$771.00, respectively. The holders may also require the

Company to repurchase the Convertible Notes if a funda-

mental change, as defined, involving Avon occurs prior to

July 12, 2003. The Company has the option to pay the

purchase price or, if a fundamental change has occurred,

the repurchase price in cash or common stock or a combi-

nation of cash and common stock. The indenture under

which the Convertible Notes were issued restricts the

Company’s ability to merge with or consolidate into

another company or to sell substantially all of the

Company’s assets.

The Company also granted to the initial purchasers

of the Convertible Notes an over-allotment option to

purchase an additional $105.0 of Convertible Notes.

As of August 8, 2000, the over-allotment option had

been exercised and additional Convertible Notes with

an aggregate principal amount at maturity of approxi-

mately $105.0 were purchased by the initial purchasers

from the Company for proceeds of approximately $50.0.

The net proceeds from the offering (including

the proceeds of the over-allotment option) were used for

general corporate purposes, including the repayment of

short-term debt.

In November 1999, the Company issued $500.0 of

unsubordinated, unsecured notes payable (the “Notes”) in

a private offering to institutional investors. The proceeds

from this issuance were used for general corporate pur-

poses, including the repayment of outstanding short-term

borrowings incurred to finance the acceleration of the

Company’s share repurchase program.

In connection with the November 1999 offering,

Avon entered into five-year and ten-year interest rate

swap contracts with notional amounts of $200.0 and

$300.0, respectively, to effectively convert fixed interest

on the Notes to a variable interest rate, based on commer-

cial paper rates. In November 2000, these interest rate

swap contracts were terminated. The cost to settle these

contracts is being amortized over the remaining term of

the underlying debt. At the same time, the Company

entered into new four-year and nine-year interest rate

swap contracts with notional amounts of $200.0 and

$300.0, respectively, to effectively convert fixed interest

on the Notes to a variable interest rate, based on libor.

In May 2000, the Company entered into an interest

rate cap agreement with a notional amount of $150.0

expiring on May 31, 2001, to convert a variable interest

rate, resulting from the interest rate swaps above, to a

fixed interest rate. The cap rate under this contract is 7%.

In May 1998, Avon issued $100.0 of bonds embed-

ded with option features (the “Bonds”) to pay down com-

mercial paper borrowings. The Bonds have a twenty-year

maturity; however, after five years, the Bonds, at the

holder’s option, can be sold back to the Company at par

or can be called at par by the underwriter and resold to

investors as fifteen-year debt. The coupon rate on the

Bonds is 6.25% for the first five years, but will be refi-

nanced at 5.69% plus the then corporate spread if the

Bonds are reissued.

41